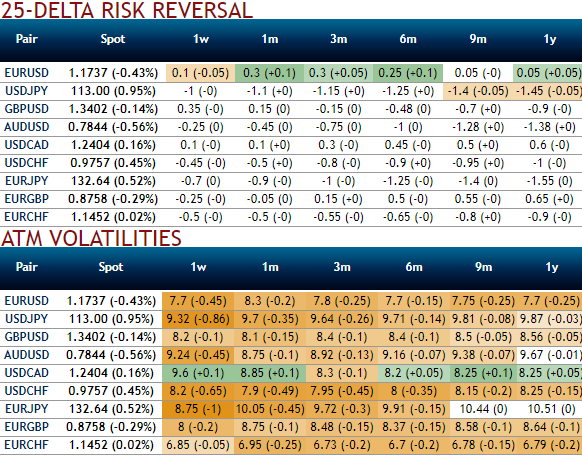

Before we proceed through the core part of this write up, let’s have a glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment despite the below stated SNB’s monetary policy announcement and upcoming data events. These lower volatile conditions are conducive for the option writers.

Despite uptrend that we’ve been seeing in EURCHF, positively skewed IVs indicate hedgers’ interests for OTM put bids.

Please also be noted that the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but bearish neutral risk reversals indicate that this pair to have been hedged for the downside risks as it indicates puts have been relatively costlier.

Let’s just shed some light on currency valuations:

The Swiss National Bank (SNB) still found that franc valuations were high, while, in its quarterly assessment, it no longer considered the currency to be overvalued.

This isn’t an ambiguity, we regard this reassessment as an indication that the SNB would not weaken the franc through active intervention at levels around 1.15.

EUR-positive market sentiment is dampening the downward pressure on EURCHF. Therefore, only mild interventions should allow the SNB to slow any downward moves in EURCHF.

Hence we only see a marginal risk of the SNB stopping its interventions in view of rising currency reserves in order not to threaten financial stability on the back of its inflated balance sheet.

EURCHF should hover level off around 1.15. We consider much higher levels to be justified only once ECB rate hikes are imminent. However, we do not expect this to happen before 2019.

Hence, contemplating the set of above aspects drives us to formulate below options strategy, anyone who wishes to carry long EURCHF exposures, a collar options trading strategy is recommended.

This could be constructed by holding total number of units of the underlying spot FX while simultaneously buying protective put and shorting call option against that holding. The puts and the calls are both OTM options having the same expiration month and must be equal in number of contracts.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms