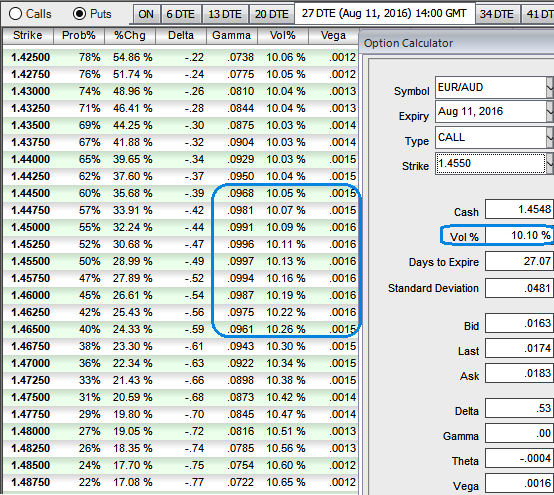

The above diagram demonstrates the equal probabilities of gamma effects when you move towards on either direction of OTM or ITM strikes.

These gamma values measure the rate of change of the delta with respect to the movement of the rate in the underlying market. In the sensitivity table, gamma shows how much the delta will change if the underlying rate moves by 1%.

While volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The current spot FX reference at 1.4548, even if you shift either sides (upper strikes or lower strikes, volatility smiles seem to be stable.

But considering the prevailing major bear trend of this pair and sensitivity analysis, unlike a simple naked put, option strips have an extra-long on put side and also with the upside protection as well. The leveraging effects is also an added advantage favouring the major trend.

So, the recommendation, for now, is to go long in 2 lots of 2M At-The-Money Vega puts that would function effectively in higher IV times. And on the other hands, go long in 1 lot of 1M at the money call option.

The strategy is likely to generate assured returns regardless of swings on any directions, even if it drifts sideways the premiums will wipe off on time decay and the maximum cost of trade would be to the extent of initial premiums you’ve paid.

EURAUD ATM options would be far more sensitive since higher IV greatly increases their chances of expiring ITM which is why we prefer ATM strikes to adding more weights in the longs of this strategy.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation