Bullish CAD & EUR into this week’s BoC & ECB’s monetary policies (on Wednesday and Thursday respectively). While EUR fundamentals are constructive into ECB; bullish targeting 1.16 levels.

Both BoC and ECB meetings should deliver a constructive message with a focus renewed focus on policy normalization.

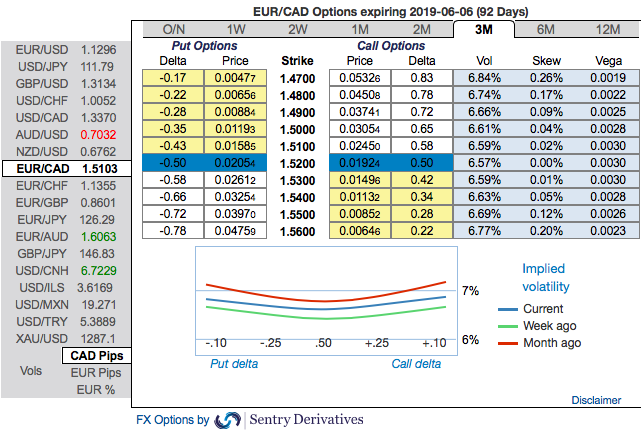

EURCAD OTC outlook: Despite the BoC event, the implied volatilities of this pair have been on the lower side, ranging between 6.77% - 6.84% in 3m tenors. Please be noted that the IV skews of this tenor have been balanced on either side. The positively skewed IVs are stretched on both OTM calls and OTM put options, the underlying movement with lower IVs is interpreted as a conducive environment for writing overpriced OTM calls. Using the three-leg strategy would be a smart move to reduce hedging cost.

EURCAD has dipped from 1.5126 to the current 1.5102 level but spiked previously from the lows of 1.4876 to the peaks of 1.5640 levels. Further material upside risks from the current levels will likely only come on a gradual basis given the BoC’s dovish rhetoric sees in upcoming monetary policy.

The Execution of Options Strategy: At spot reference: 1.5102, contemplating all the above driving forces and OTC indications, we uphold our previous strategy by advocating initiating longs in 3M EURCAD at the money -0.49 delta put, and go long in at the money +0.51 delta call of similar expiry and simultaneously, short 2w (1%) out of the money calls. Thereby, we favor slightly on upside risks as short leg likely to reduce long legs. Courtesy: Sentrix

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 42 (which is bullish), while hourly CAD spot index was at -82 (bearish) at 05:33 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?