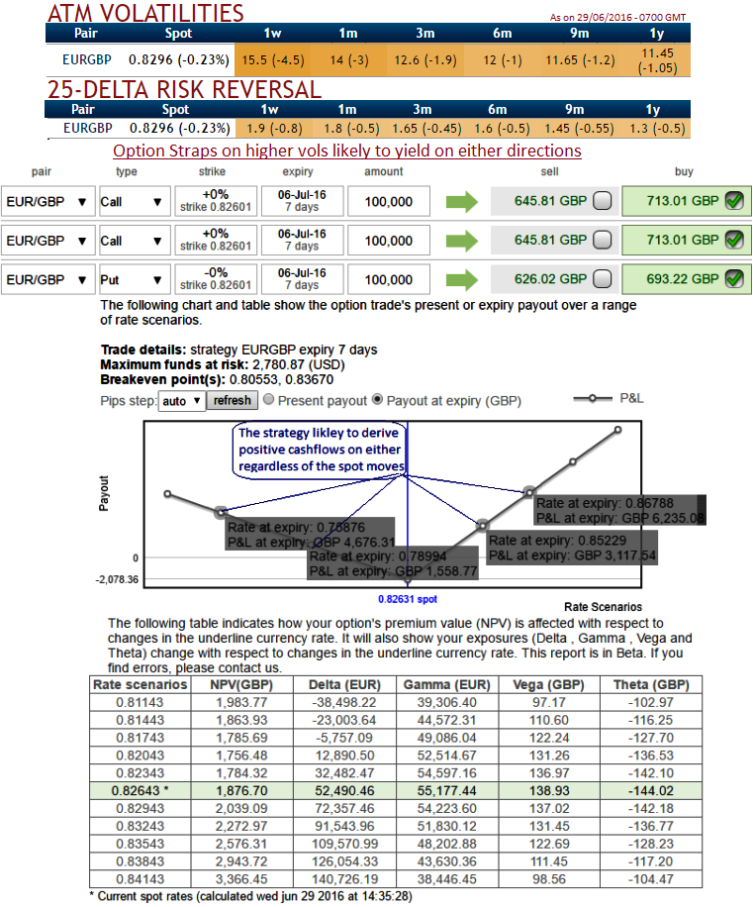

Please observe in the above nutshell showing IV shifts on a lower side but still above 15% that shows the intensity in hedging activities.

And the sensitivity tool evidences the efficiency of the options strategy as to how the vega has been responsive to the implied volatilities of EURGBP along with positive delta risk reversal numbers (even though positive tickers have been reduced.

But in a long run, hedging arrangements for upside risks are still visible (flashing at positive 1.8 for 1 month expiries to -1.3 for 1Y tenors).

1W at the money volatilities of 50% delta calls and puts are at trading around 15.25% which is reasonable as the vols currently are working in the interest of option holders as you can see IVs (still the 2nd highest among G7 currency space after GBPUSD) and corresponding movements in vega.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

Technically, , the pair has evidenced more than 61.8% Fibonacci retracements when bulls made the bottoms at 0.6975 levels and rejected exactly at 78.6% levels (see monthly charts).

Our bets for now, is to catch the decisive dips to build fresh longs as we could still foresee the momentum in the rallies.

Bulls hold stronger along with bullish momentum after jumping above DMAs and EMAs.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 2W ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of the same expiries.

Since we anticipate upswings in near term as per the signals generated by technicals as well as from risk reversals, this EURGBP option straps strategy should take care of both upswings and downswings, and yields handsome returns on the upside in the short term.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close