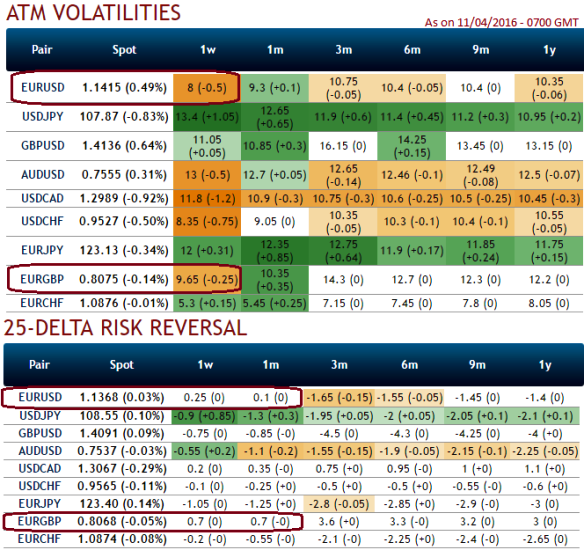

The implied volatilities flashed screaming off as the euro crosses tumbled reasonably ahead of the data events in this week, especially German & French CPI and euro area trade balance.

The above table ranks in rising implied volatility among G20 currency crosses, euro's vols against sterling and dollar are shrinking away due to this week's economic events but likely stabilize in coming months.

IV and risk reversal readings of EURUSD and EURGBP have been the best bets on shorting opportunity in options and buying signals respectively on the respite from sellers.

The implied volatility of ATM contracts for EURGBP of 1 week expiries have dipped below 10% (9.65% to be precise) and are spiking sky rocketed above 14% of far- month expiries which is the second highest among G10 currency space.

While delta risk reversals flashing up progressively with positive numbers over long term that signify hedging arrangements for upside risks but for next a month or so it has been bullish neutral, correlating this with IVs and daily price behaviour on technical charts some minor corrections are likely.

At such circumstances, OTM call strikes lure reducing the hedging costs as lowering IVs with neutral risk reversals unlikely to show upside risks.

But, considering long term OTC market positioning we think upside risks are on the cards in next 3 months duration, as result we reckon deploying longs in ITM instruments in hedging strategies are worthwhile and shorts in OTM strikes with narrowed tenors.

At spot reference of EURGBP - 0.8015, and is anticipated to remain either in sideways or slightly weaker in short run and spike up again moderately in the future.

Hence, we decide to initiate a diagonal debit spreads at net credits capitalizing on IVs, RR and overpriced OTC calls.

So, buy near month (-0.70) in the money calls with 50% delta, simultaneously, short 1W (-1%) out of the money calls with positive theta.

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  SpaceX Pivots Toward Moon City as Musk Reframes Long-Term Space Vision

SpaceX Pivots Toward Moon City as Musk Reframes Long-Term Space Vision  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast