After monetary policy season from ECB, Fed and BoE, the OTC turbulence seems cooling off, as the hedging sentiments for certain currency pairs have been losing the traction. Especially, EURGBP, with BoE's unchanged bank rates at 0.5% were already factored in as it was much anticipated move that kept sterling away from much of hedging activities.

But the implied volatilities flashed screaming off as the sterling crosses surged because BoE delivered as per street's anticipation (no dramtic changes in IVs observed like it spiked during ECB season). However, these vols are likely to pick up again in 1-3M expiries as UK referendum is scheduled on June 23rd.

After BoE's event today, sterling gained against the majors, EUR/GBP was down almost 1.12% at 0.7823 from the highs of 0.7911 earlier European session.

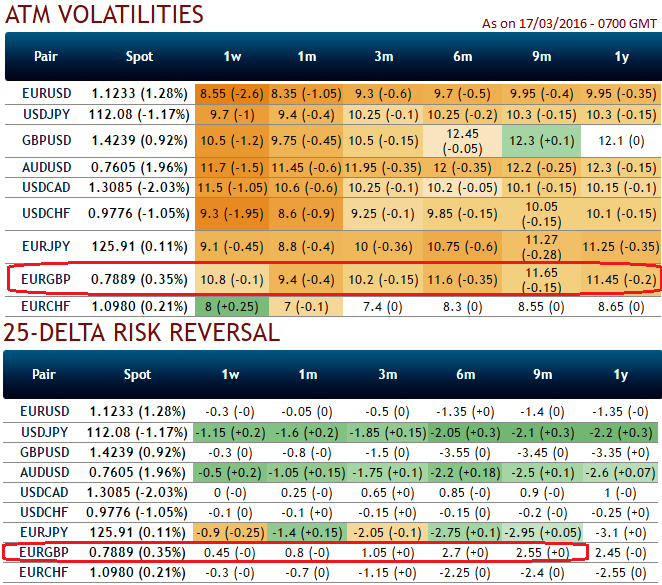

The above table ranks in rising implied volatility among G20 currency crosses, euro overreacting due to tomorrow's economic event but likely stabilize in coming months. IV and risk reversal readings of EURUSD and EURGBP have been the best buys on the respite from sellers.

Hedging bets:

The implied volatility of ATM contracts for far month expiries of EURGBP are picking up at more than 10% again which is considerably higher for far month option holders.

While delta risk reversals are still flashing up progressively with positive numbers that favours bulls and indicates they are willing to pay OTM strikes in higher vols.

Since, IVs of ATM contracts are at higher levels with positive risk reversals would mean that calls have been overpriced relatively to the puts.

During Brexit scenario, at spot FX of EURGBP is trading at 0.7823, and is anticipated to spike up moderately in the months to come, so it is better to hedge by going long in far month at the money calls with 50% delta, simultaneously, short 1M (1%) in the money put with positive theta.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate