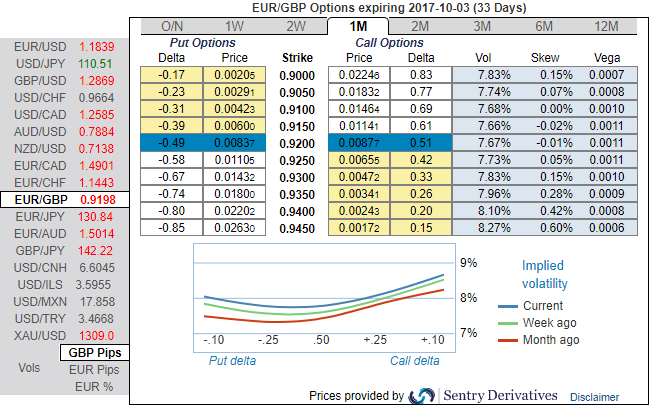

The implied volatility of ATM contracts for near month expiries of EURGBP is a tad below 8% for 3m tenor and remained below 7.75% for 1m tenor, these tepid IVs among G10 FX space appears to be conducive for overpriced call option writes in bullish hedging strategies as the delta risk reversals are also flashing negative flashes in bullish risk sentiments that signify hedging arrangements for upside risks amid minor corrections over the period of time.

While 1-3m IV skews are also in tandem with this indication, well balanced on both OTM call and puts for 1m tenors, and signifies upside risks for 3m tenors.

Contemplating above OTC market reasoning and fundamental factors we think further upside risks are on the cards amid minor hic-ups, as a result we reckon deploying longs on ATM call option with delta being at around +0.51 in hedging strategies are worthwhile and to reduce the cost of hedging we would also like to write over OTM puts as the northward forecasts remain maximum upto 0.94 mark.

Please note that using above OTC FX market rationale, seek for overpriced OTM calls of 1m expiries where IVs are shrinking below 7.75% (you would get to know this while comparing with NPV of that option), if you see any disparity between pricing and IVs, use that as an optimal opportunity for shorts with a view to reduce cost of hedging.

Hence, with this perspective, we advocate holding a 2-month 0.9025-0.9410 EURGBP call spread, marked at 0bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing -43 (which is bearish), while hourly GBP spot index was at 41 (bullish) at 11:52 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge