This week, although EURGBP is losing in its price, we remain bearish of GBP, and forecast a 5-10% move from here in GBP/USD, taking the pair below 1.25, taking EUR/GBP to a little above 0.90. EURGBP was at 0.8616 from yesterday’s close at 0.8613.

That justifies GBP shorts, but the appeal of EURGBP long is not so much our expectation of a circa 5% move higher over time, but the potential for a much bigger move if the Euro rallies across the board after a long period of sideways trading.

Parity is reachable The Euro’s sharp fall in 2014-2015 was caused by the divergence between Fed and ECB policy, which widened interest rate differentials, but also by the ECB’s bond-buying operations, which had a huge impact on capital flows from Europe.

German business confidence improved much more than expected in September, as uncertainty over Britain's vote to exit the European Union abated, industry data showed on Monday.

OTC Outlook and Hedging Strategy:

OTC outlook and hedging strategy:

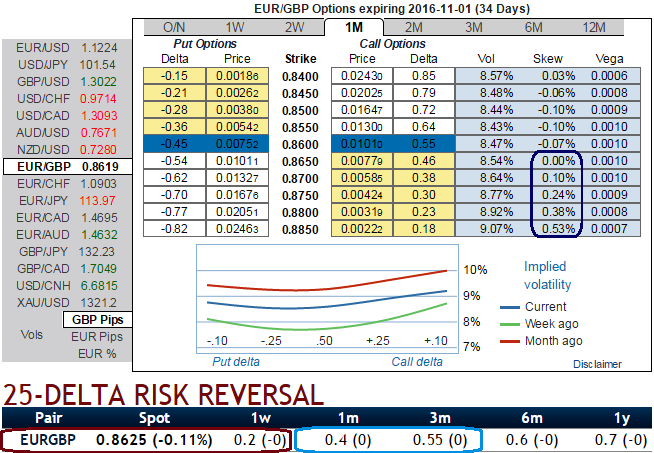

Delta risk reversals of EURGBP: From the nutshell showing delta risk reversals of EURGBP, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts but negative hedging sentiments in 1 week’s tenor

Needless to specify, GBP vols have still been flying high pace no matter what both prior and post-Brexit events, but this time, these IVs are also owing to BOE’s monetary policy decision.

So it is advisable to initiate Diagonal Credit Call Spread (DCCS) in order to tackle both short-term dips and major uptrend.

Execution: Keeping the above fundamental factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

Usually, pondering over the option sensitivity tool, IVs and OTC indications these puzzling could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases. One can understand from the IV and risk reversal nutshell that 1w tenor signifies bears hedging interests and so is the sentiments in the long run.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure