FX OTC outlook:

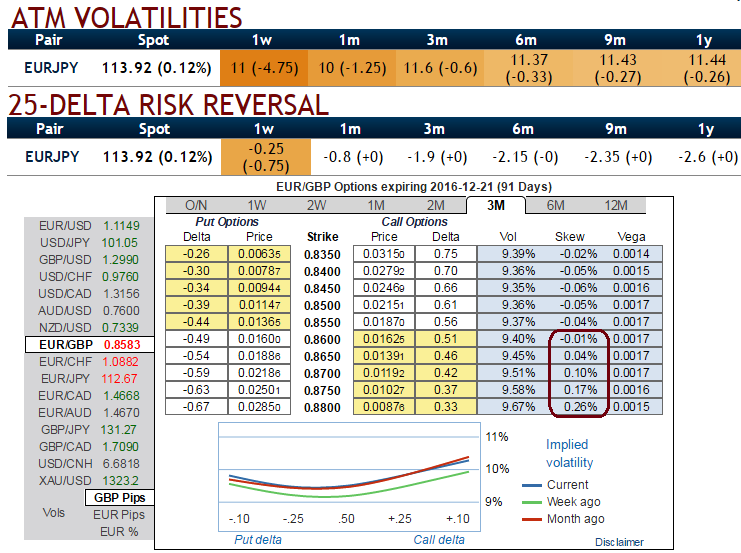

Since 1W EURJPY implied volatility has been declined massively on the back of BOJ’s shift in its monetary policy, slight bullish swings were observed today in spot FX (day highs at 114.395), but collapsed again to the current 112.701 levels. By that we mean both intermediate and major bear trend remains intact, as a result, we recommend a short vega strategy as follows via option strategy.

Risk reversals have been mounting to extreme bearish bias in these tenors.

Why to hedge EURJPY spot FX risks:

Technically, EURJPY continued sensing bearish pressures today despite upswings after testing stiff resistance at 21DMA, both leading as well as lagging indicators converge for downside risks in the long run.

Implied volatility skews of 3m tenor have been positively skewed to the OTM put strikes that signify the hedgers' interests for further downside risks.

We think current macro situations lead the central banks in both territory to almost defer policy actions, but manipulative statements on monetary policy outcome may keep EURJPY at stake.

Hedging Framework:

So, Buy EURJPY put ladder strikes (1% ITM: ATM: 1% OTM)

Spread ratio: 1:2

So, go long in 3m (1%) ITM +0.65 delta put and simultaneously short in 2 lots of puts (i.e. 1 ATM and (1%) OTM put) with shorter expiries (per say 1W expiries) and positive theta values.

Since 1W implied volatility has collapsed and likely to shrink away again when risk reversals are bearish comparatively to 1-3M expiries which is good for option writers in next 1 week,

Thereby, short premiums finances the long positions, capitalize on upswings and hedges the downside risks in spot FX with reduced or no hedging cost.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis