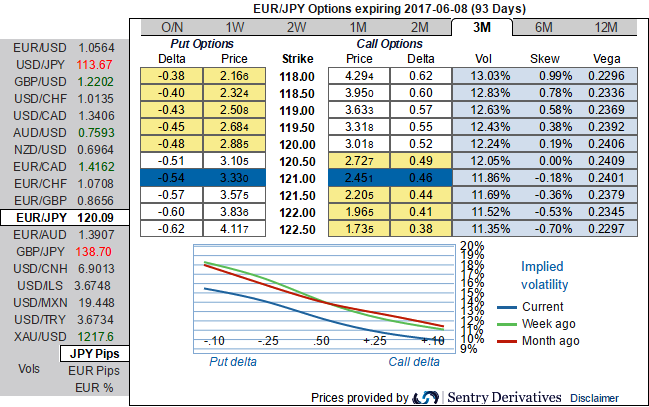

The EURJPY volatility surface is currently offering very attractive opportunities, as ATM volatility is rich and 6m/1y skews are excessively priced. Here, we recommend a couple of trades taking advantage of both the volatility and skew premiums.

In the volatility space, going short a 6m variance swap provides extremely high-profit odds. EURJPY 6m realized volatility has spent 78% and 89% of the time below the current variance swap bid level since 2007 and 2011 respectively.

Volatility trade: go short EURJPY 6m variance swap @14.3 (EUR indicative bid).

Trade risks: 6m realized volatility below 14.3 in 6m. Investors receive or pay the squared difference between the 14.3 strike and the terminal realized volatility and face unlimited losses if realized volatility is beyond this strike level.

Naked Strangle Shorting:

Short 1W OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Overview: Trend to go in sideways in the medium term but slightly bearish in short term which is why we kept extra bracket on put leg.

Time frame: 7 to 10 days

One can use this option strategy in lower IV circumstances. The above positions result in a net credit to put on the trades.

Hedging Frameworks:

Euro and oil have a decent downside on a Le Pen victory: euro could fall about 10 cents (10%) to about 0.98 over a few weeks and oil could decline by 5-10%.

In the remote scenario of a Le Pen Presidency with supportive government and Parliament, 10Y Bunds could approach 0bp and 10Y France-Germany 200bp, with sharply wider Bund swap spreads (54bp), FRA/OIS (20bp) and EURUSD cross currency basis (-60bp), and higher volatility (Bund implied 6bp/day).

For now, please be noted that the OTC indications of 1-3m combinations are the most conducive for the construction of put ratio back spreads.

We’ve already highlighted in our recent write ups on richness in EURJPY skews.

The EURJPY volatility surface is currently offering very attractive shorting opportunities 1m/3m put ratio backspreads, as ATM volatility is rich and 1m/3m IVs are positively skewed. Here, we recommend a couple of trades taking advantage of both the volatility and skew premiums.

Although 1m risks reversals are bidding for higher prices in underlying EURJPY spot FX in run up of European elections, with downside risks in long run (3m RR) and 1m IVs are shrinking away while 3m IVs rising, Hence, one could write 1m ITM put options, while adding longs in 3m ATM or OTM put options simultaneously.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One