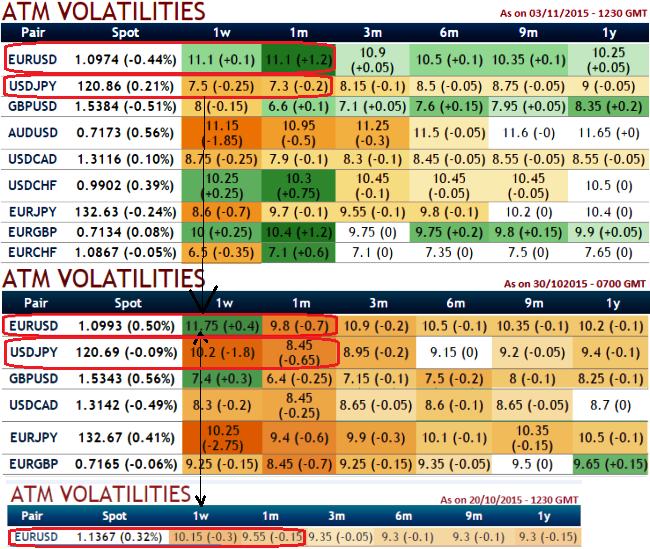

The central banks (BoJ, BoA and Fed) remained firm on their monetary policies that utters again unchanged interest rates, this is revolving into realized vols wiper and liquidity declines seasonally into year-end.

As a result, you can observe the same into ATM volatility nutshell, EURJPY to have perceived reducing IV of ATM contracts amongst the G7 pool. The scenario wasn't the same just a week ago when it was on the verge of more easing likelihood from central banks.

Trade tips:

We recommend EUR shorts vs. PLN outright and vs. RUB via put spreads.

We hold UW EM FX, as we still see distinctive risks dominating on a higher likelihood of DM stimuli (ECB and BoJ), PBoC easing and USD/CNY stability through year-end.

In recent updates on delta risk reversal of USDJPY ATM contracts, it is understood that the ATM calls have been on high demand (this is just the resultant sentiments from recent rallies) and looks overpriced which divulges the positive market sentiments for USD/JPY pair.

Buy USD/JPY 1.5% ITM 0.5 delta call with longer expiry (let's say 1m tenor). Sell two lots of OTM strike calls (124.275). Thereby, we've formulated the strategy so as to suit the delta risk reversal.

FxWirePro: EUR, JPY reduced vols after central banks stand pat - stay short in dollar via ratio spread, EUR via put spreads

Wednesday, November 4, 2015 7:26 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate