On the ECB front, markets may have to contend with increased central bank speak, with scheduled appearances from Monday-Thursday, starting with Constancio (1300 GMT) and Praet (1645 GMT) today. Draghi’s appearance on Wednesday may be noteworthy, while ECB meeting minutes are due on Thursday. This week, watch for any references to global trade tensions (and its impact on the EZ economy), although attention may remain more focused any potential signaling with respect to the ECB’s forward guidance for the coming months.

On the flip side, the RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%.

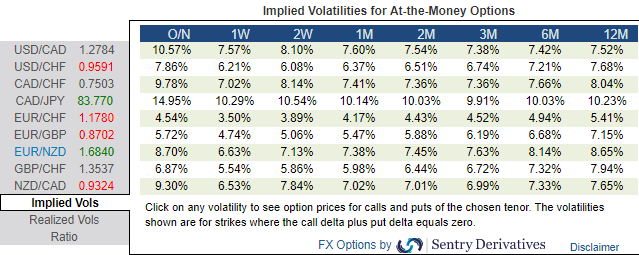

Please be noted that 3m EURNZD IV skews have been indicating hedging sentiments for the bullish risks, positively skewed IVs upto 1.73 levels.

While we pair EUR vs NZD to neutralise the risk to EURUSD from a further repricing of the Fed. The RBNZ is an unlikely candidate to signal tighter policy as the slowdown in migration intensifies the downturn in housing and argues against a policy response to upside inflation risks from minimum wage increase etc. The 3m window KO halves the premium compared to a digital call.

Long a 6m 1.80 EURNZD digital call with a 3m 1.80 window KO. Paid 17.5%. Marked at 19.04%.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -52 (which is bearish), while hourly NZD spot index was at 80 (bullish), USD at 96 (bullish) while articulating at 10:05 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data