Background: FOMC tiptoes toward December, Fed officials have done little to persuade the markets that a hike is imminent and we believe the FOMC has little appetite to deliver a surprise. As a result, we think the Fed is unlikely to act next week.

The meeting should, however, prepare the ground for a rate hike in December. The statement’s description of recent economic developments “expanding at a moderate pace” is unlikely to undergo significant changes.

Consequently, the short-term volatility is likely to benefit the USD - Diverging monetary policy indicates a weaker dollar. We see a next Fed hike in December and three hikes in 2017. The ECB is likely to cut the deposit rate to -0.6% and increase its asset purchases.

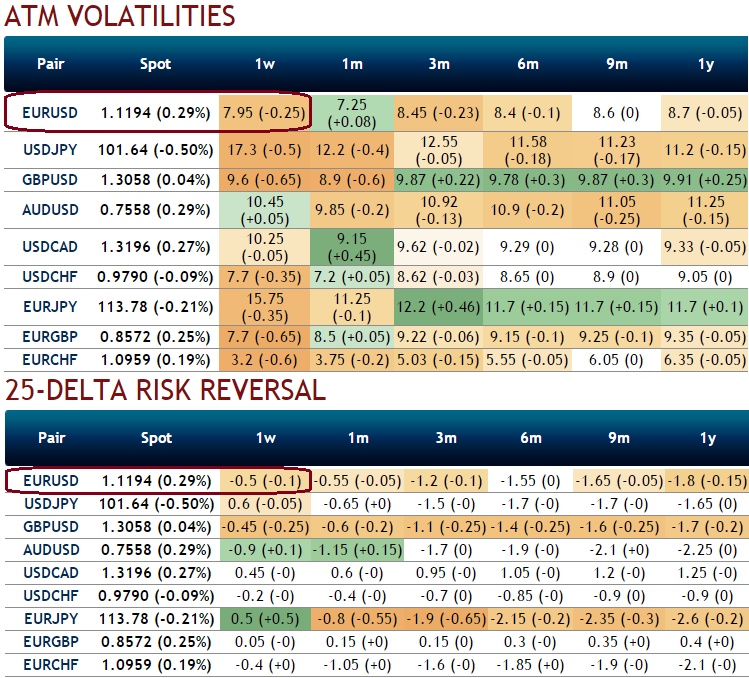

While current IVs of 1W ATM contracts of EURUSD are crawling reluctantly a tad below 8%, a massive drop from recent times, as a result option premiums likely to shrink away on account of time decay.

The pair’s risk-reversals should be pressured further to align with the impulsive retracement in spot.

Data radar: US building permits (Tuesday) expected to show increase, FOMC statement and funds rate decision (Wednesday), US unemployment claims (Thursday) to flash unchanged numbers, yet jobless numbers to slightly increase from 260k to 261K.

We advise below option strategy so as to monitor the turbulent spot FX swings on account of above fundamental events in this week.

Option Strategy:

Well, if you are perceiving the pair’s non-directional trend is likely to prevail, then the strategy goes this way for you, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit, all strikes should have similar tenors.

Since the EURUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs and neutral to slightly bearish risk reversal sentiments, accordingly we construct the multiple legs of option strategy for regular traders of this currency cross when there is little IV.

For the total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Using options expiring on the same expiration month, the option trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call. This results in a net credit to put on the trade.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields