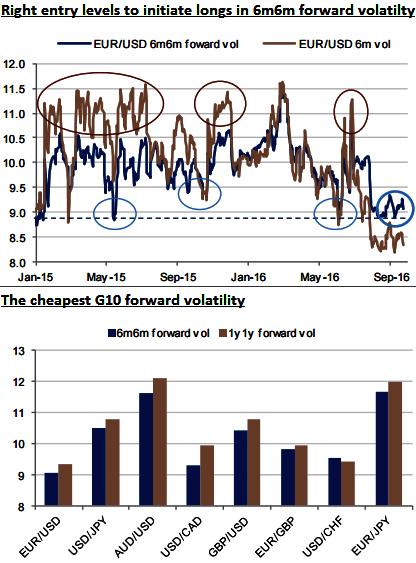

According to current market pricing, EURUSD has the cheapest forward volatility on both the 6m6m and 1y1y tenors (see above histograms).

From the vol study, it is reckoned that it seems to be a good entry point to buy forward volatility with a 6m-1y segment tighter than 0.5 volatility points, the EURUSD presents an attractive profile for forward volatility, which is currently priced at 9.1.

In contrast, EURUSD 6m volatility has frequently traded significantly above the current forward volatility level in recent months and is at the same time near its historical bottom (see ogive graph).

We also observe that volatility experienced several spikes when 6m6m forward volatility traded in the 9-9.5 region.

The aspects highlighted above do not necessarily suggest that volatility is going to rise imminently, but it could become more supported over the medium term.

If the options market starts sharing this belief, volatility curves will tend to steepen in their vega segment. It is, therefore, attractive to consider buying multi-month forward volatility.

EURUSD has the most value among FX G10 space, the universe of the most liquid currencies is constituted by the following eight pairs, in decreasing order: EURUSD, USDJPY, AUDUSD, USDCAD, GBPUSD, EURGBP, EURJPY, and USDCHF.

EUR/USD 6m volatility is currently trading at 8.4, and in this universe is closest to the lows observed since both the start of the year and 2012. Only USDCHF volatility is slightly closer to its bottom observed since 2012. Conversely, JPY volatilities are found to be the highest.

The only risk for this suggestion is that when Vega underperforms, the investors trading a FVA receive a straddle at the forward date and are exposed in mark to market to the difference between the traded forward volatility and the 6m implied volatility in six months.

Afterward, the losses are limited to the straddle premium, computed as per the initially traded forward volatility.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?