Now if you think speculation in potential uptrend in short terms is not possible as delta risk reversal suggested calls have been overpriced then let's look at an example and a few specific scenarios with alternatives in order to get benefitted from upswings.

At this point of time, if you expect that EURGBP will spike up moderately over the next near future to $35, which is currently at 0.7163 spot FX.

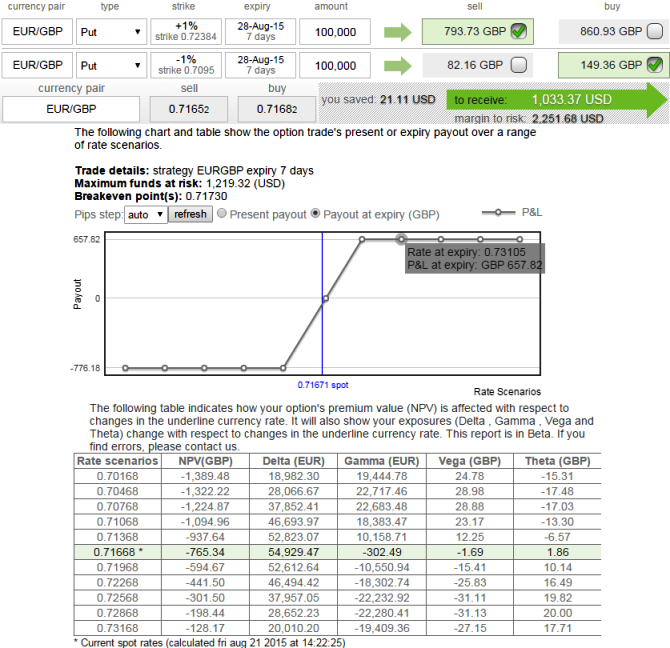

You decide to initiate a bull put spread, Buy next month +1% Out of the money -0.5 delta put for £149.54 contract covers 100,000. Simultaneously, short 15D (-1%) in the money put with positive theta for a limit price of £793.73. So thereby our breakeven would be at 0.7173. Notice in this instance that the put we bought is out of the money and the put we sold is slightly in the money with an anticipation of EURGBP could rise in short run, remain unchanged, or fall slightly and still be profitable. Maximum profit: The credit received for this trade is £644.37, less commission costs.

The maximum risk for this trade is US$ 1219.32 plus commission costs. Because the maximum risk is the difference between the two strike prices, minus the credit you received.

FxWirePro: EURGBP bull put spreads in action

Friday, August 21, 2015 9:06 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand