The Bank of England is expected to announce an increase in interest rates for the first time in more than a decade, moving the Bank Rate up a quarter point to 0.5%. The recent shift in tone among policymakers partly reflects the ongoing resilience of the economy. Further, the increase in the urgency around a rate hike has been aided by the recent resumption of the inflation uptrend and by signs of an increasingly tight labor market, which has raised concerns that the UK is potentially facing capacity constraints.

There is a large degree of uncertainty on the vote split. The median consensus is 6-3 in favor of a rate rise, according to a Bloomberg survey. The central view is 8-1, with Jon Cunliffe potentially voting for unchanged policy.

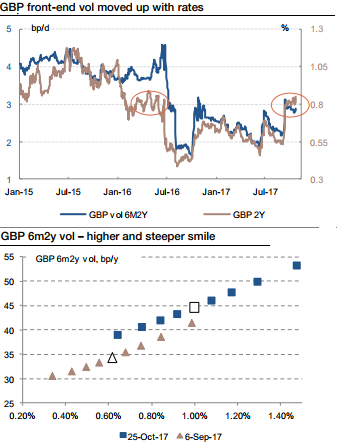

Either 1x2 receiver spread or 6m2y receiver fly Buy GBP 1x2 receiver spread ATMF+10bp/ATMF-6bp – zero-cost (indicative). Indicative GBP 6m2y fwd 0.99%, spot 0.85%. At expiry, the strategy generates the maximum profit of 16bp if the GBP 2y rate is roughly 10bp above the current levels (and 6bp below the current 6m2y forward). If rates increase more than 10bp above the 6m2y forward, the PL is zero. For those averse to the risk of unlimited losses Buy GBP 6m2y receiver fly ATMF- 15bp/ATMF/ATMF+15bp – for 3bp running (indicative). The maximum payout of 15bp is realized at expiry if the 2y rate converges to its 6m2y forward. The maximum payout is 5 times bigger than the premium paid (15:3).

The front end is priced for a hike A stronger than expected 3Q GDP reading sets the scene for a BoE rate hike at its meeting on 2 November. The MPC dated SONIAs are already 90% priced for this outcome meaning the front end of the curve will not re-price but should continue to trade as if the next move is a hike. Over the next six months or so, current forwards at the front end of the GBP swap curve are expected to realize.

History suggests that the back-up in GBP 2y swap rates comes ahead of the first hike and that there is some stability thereafter. The swaption market allows expressing this view in a leveraged way, benefiting from the recent spike in GBP short rates vol (refer above graph) and from the steep smile (refer above graph). Both of these trades deliver maximum profits if the 2y rate is around (but below) its 6m forward rate in 6m time. Courtesy: SG

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target