You could expect the prospects of expansionary fiscal policy in the US under Trump regime that likely drives US interest rates higher and therefore strengthen the dollar further. Trump is also likely to protect US manufacturing in order to generate more and more employment and this could actually narrow US trade deficit.

The Trump presidency will run until 2021 which will be among most inflationary in last few decades and market has already started discounting it, Fed rate has not been an exception, which is likely to rise more than once in 2017 which in turn, yields on US treasuries are surging higher. Also, the US Fed has stepped up monetary policy tightening and had signaled for more tightening in next few policy meet in 2017. This, in turn, is also creating sufficient ground for inflation to rise.

Trump may put a break on long-term interest rates and convince Fed not only to refrain from further interest rates hikes but also to launch another round of long-term treasury debt purchases in case the economy loses momentum, another round of quantitative easing. Further, his proposals to increase spending and cut taxes will fuel economic growth in 2017 and will thus, also prompt Fed to raise interest rates.

The probability of 50-75 bps rate hike during the first half of 2017 while 25-50 bps in the latter half of 2017 is higher according to the current reading of CME Group’s FedWatch tool. This indicates that there is the high level of confidence in the market about the Fed decision to hike interest rate in 2017.

OTC updates:

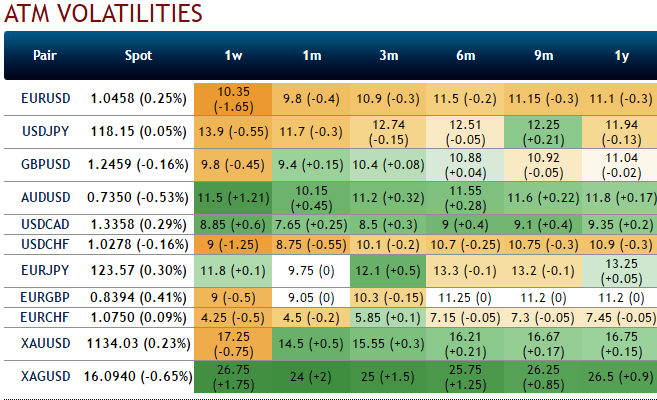

Please be noted that the IVs of dollar crosses are considerably increasing in longer tenors except EURUSD. As shown in the diagram positively skews in AUDUSD shows the hedgers interests in OTM puts, as a result, we could expect more bearish risks in this pair, while USDCAD has been bullish as the positively skewed IVs signal OTM calls are on more demand comparatively. You could probably understand by now, the impact of Fed’s hints of more hawkish approach in its monetary policy in upcoming meetings.

Well, to understand the volatility construction procedure in FX market strategies, the FX specific delta and ATM conventions knowledge is crucial.

In FX option markets it is common to use the delta to measure the degree of moneyness. Consequently, volatilities are assigned to deltas (for any delta type), rather than strikes. For example, it is common to quote the volatility for an option which has a premium-adjusted delta of 0.25.

These quotes are often provided by market data vendors to their customers. However, the volatility-delta version of the smile is translated by the vendors after using the smile construction procedure discussed below. Other vendors do not provide delta-volatility quotes. In this case, the customers have to employ the smile construction procedure.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data