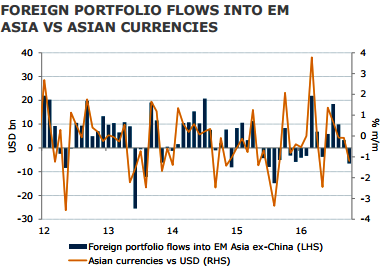

October was the first month since June that total portfolio outflows were recorded.

Though Korean equities managed their eighth straight month of inflows, at USD0.3bn it was not enough to offset the USD3.2bn of outflows from the debt market. Foreign investors have been net sellers of Korean debt for three consecutive months.

Selling had been concentrated in monetary stabilization bonds in October. The outflows contributed to the poor performance of Korean asset prices in the month, with the equity market down 1.7%, 10-year KTB yields rising by over 25bps, and the Korean won depreciating by 3.7% against the USD – making the KRW the worst performing currency in the region.

The BoK left its base rate steady for the fourth straight month at the record low of 1.25 pct at its October meeting, as anticipated.

The EM strategies have turned underweight on Asia FX given a combination of higher core yields, the break out of USDCNY to above 6.70 and multiple idiosyncratic issues. KRW is a notable candidate to short given that it has among the highest sensitivity in Asia to CNY weakness.

The capital outflows from China had already picked up before expectations of a Fed hike and despite resilient data.

The additional dynamic of USD strength and expectations of a Fed hike in December suggests that risks to capital flight are skewed to the upside in Q4.

In addition, the added uncertainty on corporate earnings has the potential to slowdown equity inflows from offshore investors. So, long USDKRW are encouraged at 1135.90 on hedging grounds via 2m NDFs.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist