FOMC is scheduled to announce its funds rates today, the US Federal Reserve is unlikely to disappoint the market tonight. It is expected to raise rates by 25bps, moving the target range up to 1.75-2.00%. If this occurs, attention will shift to the future. The committee’s last set of forecasts in March showed a pretty even split over whether to raise rates three or four times this year.

However, economic developments since then have increased the odds that the Fed will raise four times and we expect that to be reflected in the ‘dot plot’ of members’ median interest rate forecasts. There are also likely to be upward revisions to the estimates for GDP growth and inflation.

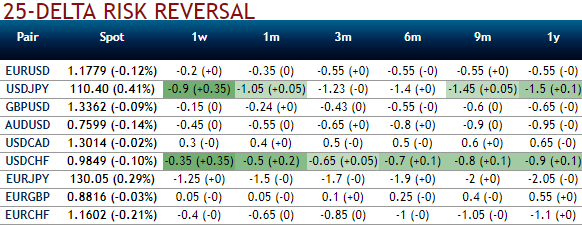

Ahead of this monetary policy meeting let’s just glance at the OTC outlook: The positively skewed IVs of EURUSD of 3m tenors signify the hedging interest of bearish risks while mounting bearish risk sentiment is substantiated by bearish neutral risk reversal numbers.

Contemplating above-stated driving forces and OTC indications as shown above, accordingly options strips strategy is already advocated about a fortnight ago on hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

The shockwave in BTPs shook EUR options out of their stupor, but their swift late-week reversal leaves them once again looking cheap to bond yields. EURUSD 3M ATMs and/or 2M1M FVAs, EURCNH puts and/or risk-reversals and USDNOK vs EURUSD risk-reversal spreads are well-priced for a resurgence of Italian political stress.

From a directional perspective, near zero-cost long/ short EUR puts can conditionally position for an extension of Euro weakness without being exposed to an abrupt bullish reversal.

EUR puts/USD calls funded by a mix of EUR puts/NZD calls and EUR puts/NOK calls can deliver the desired exposure while being consistent with historical betas of Euro-crosses to EURUSD declines.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bearish technical environment in the recent past and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution:

As shown in the diagram, initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1M at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on either side but with more potential on the downside.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 60 levels (which is bullish). Hourly USD spot index was at shy above 59 (bullish), while articulating (at 10:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics