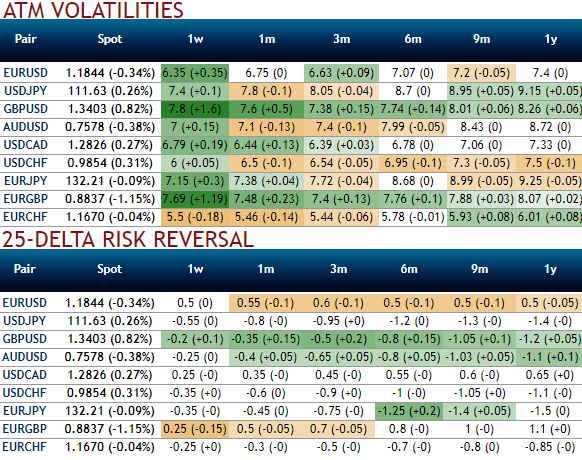

The recent increase in steepness of EURUSD vol curves is not quite a sub-1Y phenomenon. The unique liquid long-tenured G7 surface that we are meticulously monitoring for ciphers of extreme curve shape is EURUSD, where the 5Y –1Y vol spread is close to all-time wides (refer above diagram).

This is not a traditional RV dislocation in the strict sense of the term, since the curve is fair relative to the level of vol i.e. the entire curve move in recent months can be explained by the cratering of 1Y vol; by extension then, normalization of the curve should be led by a reversal higher in the latter.

This back-end vol slope in EURUSD is worth tracking closely because the last two major peaks in curve steepness in 2014 and 2016 acted as major mean reversion pivots for 1Y vol over coming months.

The current slope is 7% above prior peaks whereas historical vols are near 6.5%, our intent is to start legging into EUR 1Y ATMs perhaps 0.3-0.5 vols lower from the current market once we see a 2-handle print on the curve.

Given the depth of the Euro option market, owning EUR vol from near two-decade lows constitutes the most scalable FX risk premium normalization trade for 2018 in our view.

While please be noted that the recent shift in risk reversals are flashing negative number. However, the hedging interests for bullish risks remain intact. This standpoint is substantiated by positively skewed IVs of 1m tenors.

Hence, the 1m EURUSD call spread of net delta around 0.39 is advocated at net debit.

Contemplating above OTC market reasoning and fundamental factors we think further upside risks are on the cards amid minor hic-ups, as a result we reckon deploying longs on ITM call option with delta being at around +0.61 in hedging strategies are worthwhile and to reduce the cost of hedging we would also like to write over OTM puts as the northward forecasts remain maximum upto 1.21 mark.

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction displaying shy above 27 levels (bullish), while hourly USD spot index was at 52 (bullish) while articulating (at 06:40 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential