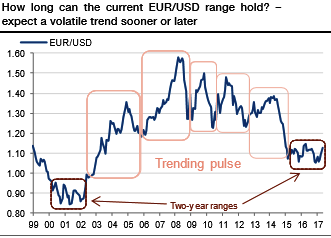

EURUSD has traded between about 1.05 and 1.16 since 2015. While these bounds are pretty wide, this has been the longest period deprived of trends since the introduction of the single currency (refer above graph).

EURUSD should move towards the top of its range in a choppy way, generating unusual topside volatility along the way.

At this stage, we think it is legitimate to anticipate that this lasting range-bound period is poised to morph into a more directional market. Indeed, we forecast an overshoot above the 1.16 upper bound by year-end, but we expect the decline of the dollar to be quite choppy. We think euro appreciation should generate more volatility.

Buy EURUSD 6m call strike 1.15, European KI on the realized volatility at 9% Indicative offer: 0.60% (vanilla: 1.61%, volatility swap: 7.6%, spot ref: 1.1226)

Trade risks: limited to premium, soft euro, and volatility. This exotic option is a standard 6m vanilla call strike 1.15, which will be activated only if the realized volatility is above 9% at the expiry. If the volatility terminates lower, the option will be worthless even if EURUSD trades above 1.15.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed