RBNZ is due to release its monetary policy statement tomorrow, wherein it announces OCR rates which is likely to remain on hold. This is going to be the last monetary policy proclamation for the governor, Wheeler in this tenure who has served since September 2012.

Kiwis central bank executives keen onto express desire for a lower currency value. The outgoing Governor stated last week that he “… would have preferred a lower exchange rate” through his term, but caveated this with the comment that “… to a large extent the high exchange rate reflects the favourable performance of the economy, high terms of trade, and weakness in the US dollar.” These comments don’t display much anxiety, but he at least repeated the OCR mantra that “… a lower NZD is needed.

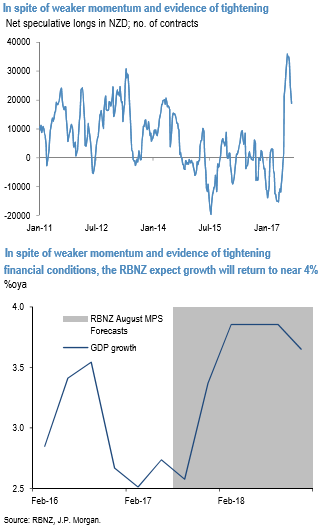

We expect NZD to fall over the next 12 months, as growth will likely continue to underperform the RBNZ’s lofty forecasts (refer above chart), housing slows (refer above chart), and as tight financial conditions restrain any requirement for OCR hikes, allowing rate compression vs USD.

We are also of the view that while systematic/model-based investors might struggle to sell NZD given where the terms of trade are, this is only an anchor for valuations to the extent it predicts growth, inflation, or the current account. On these fronts, we see the details as being less bullish than they appear.

We continue to look for a lower NZD over the coming year, as tight financial conditions, weaker growth, a housing market that has peaked and a policy rate more likely to go down than up in the next year all weigh on the Kiwi. A combination of weaker data and uncertainty ahead of the general election has driven a decent position adjustment in NZD of late (refer above chart), thus, Q4’17 forecasts would be at around - 0.70 and Q2’18 target is at 0.66. Courtesy: JPM

Trade recommendation: Contemplating above aspects, relative-value trades are advised that gives arbitrage investment opportunity that seeks to take advantage of price differentials between FX rates.

Buy NZDUSD straddles of far-month tenors vs shorting AUDUSD 25D strangle, 100:150 vega.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays