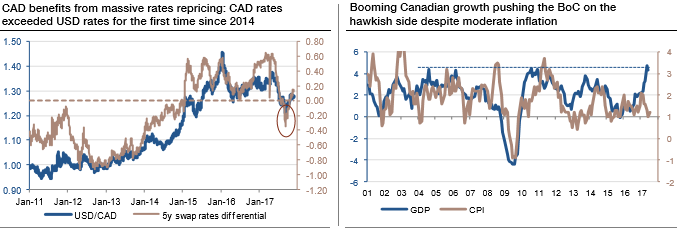

CAD rates recently climbed above USD rates for the first time since 2014 (refer above graph) as the Canadian monetary policy to be more decisive than oil prices, and the USD rates projections can realistically drag the USDCAD to 1.20.

The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor.

Solid growth to push the BoC on the hawkish side. Market pricing is currently similar for the BoC and the Fed, with the probability of two hikes in 2018 slightly above 30%. Indeed, the CAD has been boosted by the BoC's decision to raise rates to 1% in September, earlier than expected, on the back of a brighter-than-expected economic performance.

In our view, the market consensus is too gloomy on the drag to the Canadian economy from the housing market. While inflation has not yet reached the 2% target, growth indicators (consumer spending, employment) surprised on the upside, suggesting further monetary tightening (refer above graph) as Canadian real GDP is close to 3%.

CAD - cross vols are low and performing. CAD-based implied correlations are priced well below realizeds; owning CADUSD vs CADJPY corres itself or its vol spread proxy in the form of CADJPY – USDJPY vol spreads is a positive carry NAFTA hedge.

CAD-cross vols are also of interest as a potential buy given NAFTA risks in 2018, and CAD correlations that trade at a substantial discount to trailing realized corrs are well priced as carry friendly trade disruption hedges.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays