It seems that both euro and the US dollar are in demand. A mixture of cautious sentiments towards the Emerging Markets, relief following positive comments on the part of the Italian Ministry of Finance about the Italian budget deficit and government debt, concerns about possible new US tariffs on Chinese products and uncertainty ahead of the ECB meeting on Thursday. But there is nothing concrete for an entirely new assessment of our view on EUR-USD and have no real answers.

The comment period for the US administration’s plan to implement tariffs on another $200bn of imports from China ended on September 6th; if greenlighted, this would mark a significant escalation in trade tensions that have roiled markets for the better part of the year.

It is difficult, if not impossible, to handicap the extent to which the escalation of tariff risks has already been discounted into battered EM asset prices; what can be said with more assurance is that a handful of assets that screen as fair or expensive vs the global growth cycle have not factored in a more disruptive, contagious phase of the trade war.

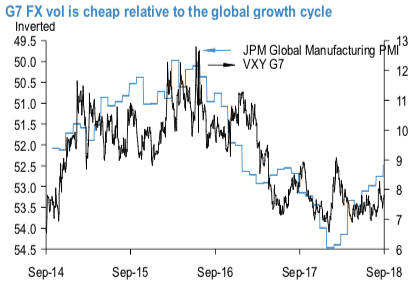

G7 FX volatility is one such cheap asset. VXY G7 is priced about 1 % pt. too low for the current level of Global manufacturing PMI, a 1 std. error mismatch (refer above chart).

In contrast, VXY EM screens 3.5% pts. too high (+3.1 std. error) on similar metrics, highlighting the EM/DM vol gap that has opened up in the past few months.

EUR and JPY are the two largest components of the VXY G7 basket and also the two biggest contributors to this cyclical cheapness.

We have already discussed EUR vol / options in the context of Italian budget risks in recent publications (e.g. Option plays for CNY basket calm and Italy risks), the gist of which is that owning EUR puts/USD calls in various formats (6M 10D puts and/or EUR vs. gold 6M 25D put switch) is appealing given the combined low vol, flat curve and positive forward points. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 4 levels (which is neutral), while hourly USD spot index was at 28 (mildly bullish) while articulating (at 09:48 GMT). For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025