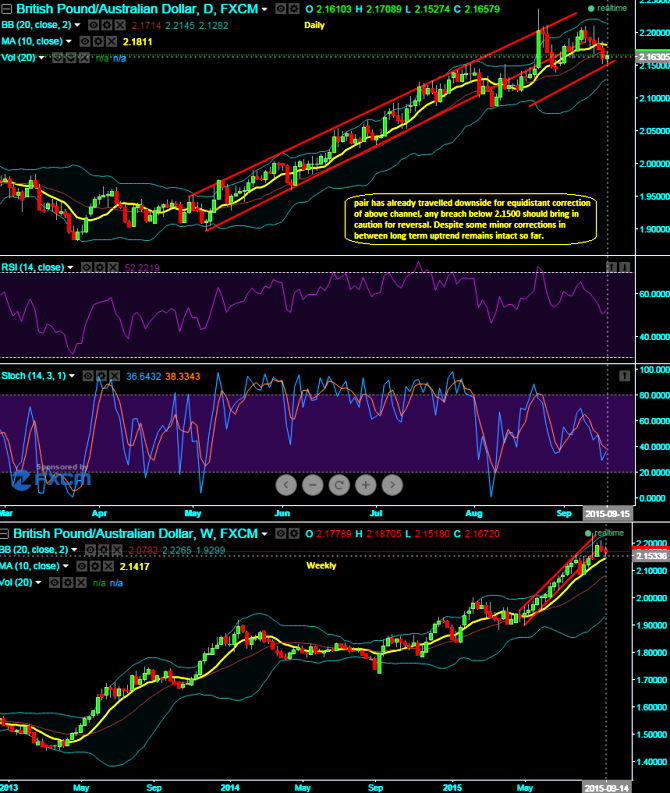

GBPAUD has already made equidistant travel towards downside (channel distance from 2.1862) when it has broken channel line at 2.1862 on daily graph, although RSI has reached overbought region on weekly chart and began showing downward convergence but signals of indecision about direction are piling up as there is no proper substantiation from subsidiary indicators. We can see weekly prices are trading well above moving average curve.

We believe GBPAUD uptrend has been quite healthy as the upswings are moving with considerable corrections at the right time and such corrections are factored in so far, you can expect some further minor corrections but certainly it has neither been steep spikes nor steep declines and you can make this out from daily charts as the oscillating indicators are also positively converging with price spikes and dips. Current 10 day moving average is evidencing long term uptrend remains intact, so it is quite absurd to buck the trend.

Trade tips: With reduced implied volatility of ATM options, it is quite riskier to build strategy with more number of shorts. Moreover, the pair has already rallied onto 2.2370 levels, so it is advisable to build portfolio with credit put spread at this point in time.

FxWirePro: GBP/AUD steep slumps unlikely despite RSI oscillator signals overbought pressures

Tuesday, September 15, 2015 8:40 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand