Do you think the political risk into French election is priced more appropriately in bonds (but not in currencies) than going into the Brexit and the US polls?

In the remote scenario of a Le Pen Presidency with supportive government and Parliament, 10Y Bunds could approach 0bp and 10Y France-Germany 200bp, with sharply wider Bund swap spreads (54bp), FRA/OIS (20bp) and EURUSD cross currency basis (-60bp), and higher volatility (Bund implied 6bp/day).

Less extreme scenarios of Le Pen Presidency but cohabitation or extreme left Presidency will likely result in considerably less extreme outcomes.

A scenario of moderate market stress with either Le Pen or a unified left candidate achieving a 30%+ score, vs either Macron or Fillon (or the “Republicans” candidate called in replacement).

Alternative scenario: The acute market stress in a confrontation between Le Pen and a Hamon/Melenchon coalition. Regardless of the probabilities of occurrence of each scenario, we make simple arbitrary assumptions for each scenario in terms of market impact in order to rank the efficiency of vanilla EURUSD hedges.

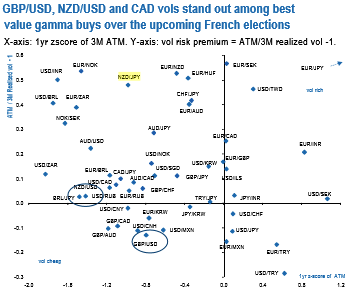

In gamma space, we find that the concentration of vol risk premia in EUR/low beta pairs leaves a number of pairs that look cheap as good value proxy hedges for a contagion stemming from above scenarios.

After all, these would have profound implications for the Brexit process at the least. Indeed, GBPUSD gamma stands out as currently cheap, along with NZDUSD and CAD crosses (refer above diagram).

USDTRY also deserves a mention as a pair where gamma has been consistently realizing, and where the 16-Apr constitutional referendum is likely to provide further support to front-end vols.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays