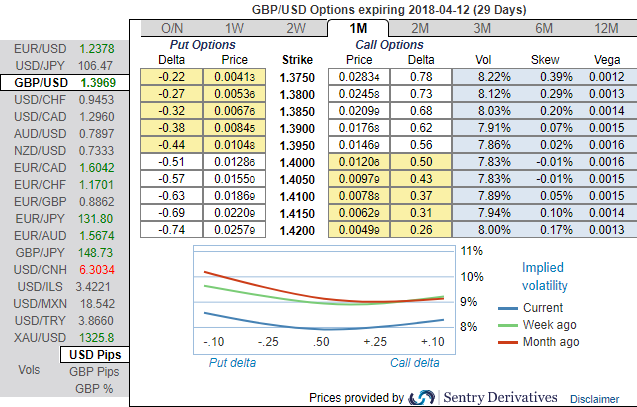

Let’s glance at GBPUSD sensitivity tool, the positive shift in risks reversals that indicate the bullish risks in underlying spot FX prices in near-term.

While positively skewed IVs of 1m tenors are well balanced that signifies the hedging interests in both bearish and bullish risks, as a result, OTM puts/call strikes likely to expiring in-the-money.

But bearish risks in longer tenors remain intact as the negative risk reversals of longer tenors indicate hedgers still bid for downside risks. ATM IVs are still stuck between 7.7%-8.47% ranges for 1-3M tenors.

Hence, in order to arrest both upside risk that is lingering in short-term trend and major declining trend, we recommend diagonal option strap strategy that favors underlying spot’s upside bias in short run and mitigates bearish risks in the medium term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bullish as well as bearish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether underlying spot keeps flying or dipping.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 105 levels (which is bullish). Hourly USD spot index was at shy above -118 (bearish) while articulating (at 11:54 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed