The GDT dairy auction overnight resulted in a 5% rise overall, with WMP up 3% and SMP up 10%. The result is roughly in line with earlier futures predictions which had priced in a response to weather affected supply.

AUDNZD upswing momentum starting to turn positive, we target 1.0700+ during the days ahead.

The pair’s prospects in next 1-3 months: Higher to 1.0750 or above, the RBA likely to remain on hold this year while the RBNZ should ease further. Moreover, the cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment.

OTC updates and Options Strategy:

1m at the money implied volatilities of 50% delta calls and puts are trading at around 7-8% which is reasonable as the vols currently are working in the interest of option holders as you can see IVs and corresponding movements in vega.

As a result of the above economic and monetary policy events, the kiwi dollar was lower against the Australian dollar, with AUDNZD edging up at 1.0616, as all key resistance levels are broken, the further upside can’t be ruled out and it is likely to spike higher on account of the NZ central bank further easing cycle is forecasted.

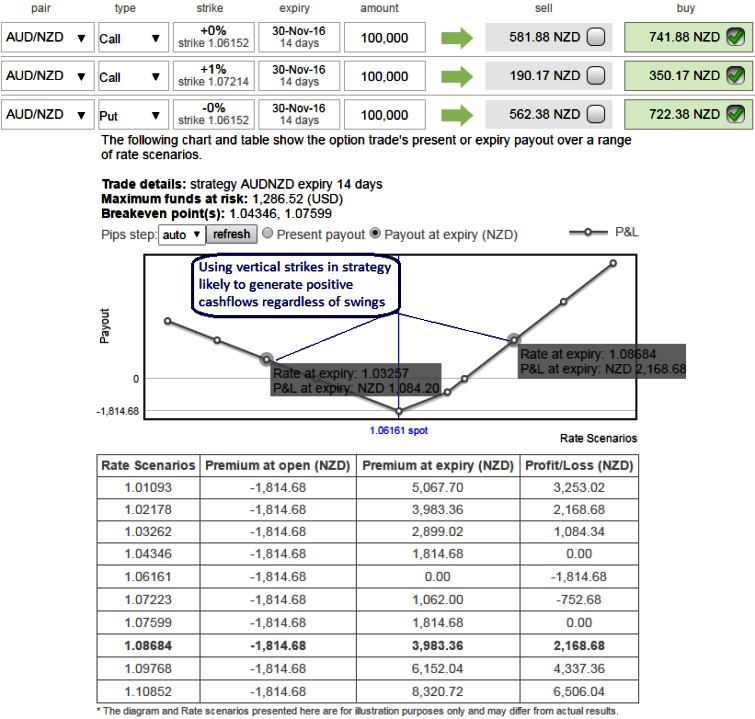

Well, in order to arrest this upside risk and to bet even on abrupt dips, we recommend option strap strategy that favors underlying spot’s upside bais.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 1 lot of 2W ATM 0.51 delta call, 1 lot of 1m (1%) OTM 0.36 delta call and 1 lot of ATM -0.49 delta puts of 2w tenor.

Since we anticipate upswings in near term as per the signals generated by technicals as well as from IVs and risk reversals, this AUDNZD option straps strategy should take care of both upswings and any abrupt downswings, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side as shown in the diagram.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data