Majority of the Asian markets are shut down for a labor holiday today. Those markets that are open are little changed following modest declines on Wall Street. The oil price is higher with Brent crude close to $75bbl on rising tensions between Israel and Iran. The Australian central bank as expected left interest rates unchanged after its latest policy meeting. Meanwhile, reports suggest that China plans to take a tough stance in trade talks with US officials this week.

Seasonally vol soft April turned out to be anything but soft. The US yield curve’s return to the forefront first in the form of concerns about yield curve flattening and inversion and later on in form of anticipation of the US 10-year breaching the 3% level, a line in the sand. The focus on the yield curve reverberated through FX markets pushing USD vols and JPY cross-vols sharply 0.4-0.5vols higher and sparking a +1.8% broad dollar rally and interest in catch-up bullish USD option prospects.

Overall, over the course of last few days, USD TWI has broken out of the two-month range and has retraced more than half of the January/February drop.

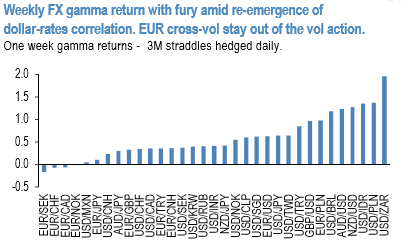

FX gamma returned with fury (refer 1st chart) amid reemergence of dollar-rates correlation and the subsequent FX spot jitters. Predictably, gamma returns concentrated within the USD vols with the high beta heavyweights leading the way. Admittedly, a big chunk of that gamma P/L came from front vols repricing as fears from dollar unwind spread. Amid the market focus on the US yields, EUR cross-vol mostly stayed out of the way of this week vol action.

With technical drivers firmly in the driver’s seat, via the US rates->FX spot->FX vol channel, we turn to assessing current VXY fair value relative to trailing realized USD vols and swaptions instead of taking our more typical approach of regressing VXY on cyclical factors.

Tracking the regression residual, the 2nd chart indicates VXY-Global to be only marginally cheap (0.5 vols) relative to those technical factors based fair value. The tight relationship also implies that absent the USD spot vol and US rates vol drivers, VXY is likely to consolidate. Consequently, we remain reserved about the longevity of the ongoing rates-spot-vol bout but do understand the need and discuss below a few options for hedging of the ongoing market. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures