In case Friedrich Merz is elected as party leader of the German Christian Democrats, CDU (and, possibly later, as German chancellor), Germany’s Europe policy would not significantly change. Accordingly, the scenario would not constitute a negative signal for the euro medium to long term.

Moreover, very far reaching demands on integration, amongst them a pan-European unemployment insurance scheme and a joint budget policy seems to be unlikely. Merz would be unable to get his party to agree to such positions, but it demonstrated that his general direction was pro-European.

However, if one believes the reports of a German news magazine, Merz has since distanced himself from these comments in internal meetings. One could now assume that distancing himself from these comments is due to his efforts to become elected as party leader in December. Whatever the correct interpretation is, the following applies: the stance towards the European Union of the – as some experts say – most promising candidate for party leadership of the CDU (implying he stands a good chance of becoming the next chancellor) is less clear than anticipation.

Hence, the prospect of a chancellor Merz would therefore be no reason for EUR appreciation.

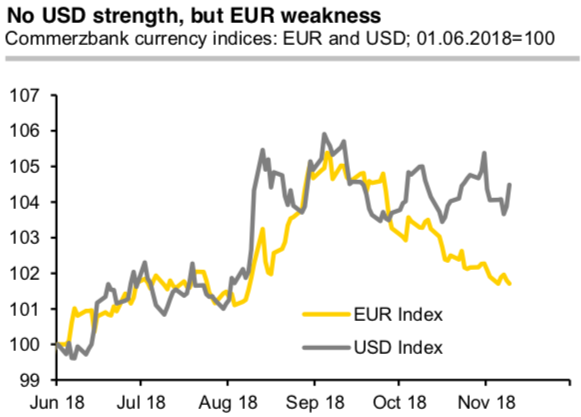

On top, we see more rumours about quick new TLTRO operations by the ECB. These news flows are damaging for the euro as they challenge the prospect of a normalisation of interest rates in the euro zone. That is the reason why we have been seeing such notable EUR weakness since early September, while dollar index is drifting in sideways (refer above chart) – and why it has been persisting while the smell of a new Italy crisis is in the air. It would be utopian to expect all of this to evaporate into thin air overnight. Until then, EUR can continue its down trend.

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 2m tenors signify the hedging interest of bearish risks.

While the negative risk reversals of 1m tenors indicates bearish risks remain intact in the major trend.

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 2m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index:FxWirePro's hourly EUR spot index is showing -86 (which is bearish), while USD is flashing at 115 (which is bullish), while articulating at (10:02 GMT). For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays