The yellow metal price would usually be sensitive to moves in both UST rates and USD. The gold prices would be more expensive for holders of foreign currency on robustness of dollar, while a rise in U.S. rates lifts the opportunity cost of holding non-yielding assets such as bullion.

The US dollar continued to recover yesterday. The softness in currency is being supported above all by the monetary policy outlook, i.e. the hope of a more rapid normalisation of US interest rates on the part of the Fed due to a quick rise in inflation. Powell is scheduled to testify on the Semi-annual Monetary Policy Report before the Senate Banking Committee, in Washington.

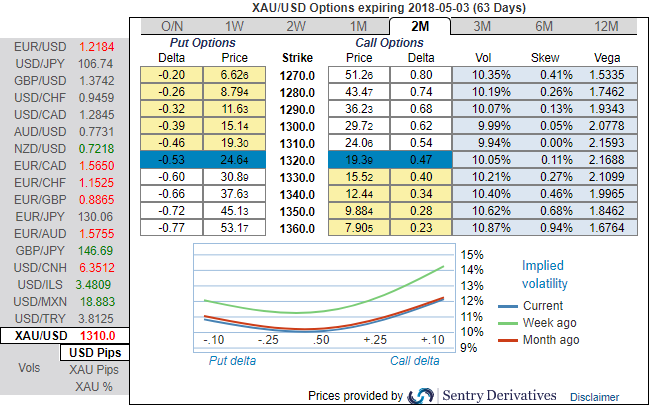

Good ownership in front end Gold skews: With Gold front vols bound to remain firm for longer and as the late cycle Gold rally takes hold on the back of the late Fed, Gold skews should stay supported even as 3M skews are at the highest level since Aug 2017. Positively skewed IVs of 2m tenor have been well balanced that signify the hedging sentiments on either side.

Returns from delta-hedged 25 delta riskies (refer above chart) have held well as skew pricing remained within range and despite an aggressive 2017 global vol sell-off.

While the Italian election may turn out to be materially more muted than last year’s French election 1st round which pushed 3M XAUUSD skews to the highs of 2.7 vols, at about 1.2 vol of positive static carry on 3M-1M segment 3M XAUUSD 25D riskies provide an attractive positive static carry risk-off hedge.

We recommend buying delta-hedged 3M XAUUSD 25-delta risk reversals @ 1.3/1.6 vol.

Currency Strength Index: FxWirePro’s hourly USD spot index has shown 48 (which is bullish ahead of US unemployment claims and Fed chief Powell’s testimony) while articulating (at 12:06 GMT), for more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics