Gold prices continued their rollercoaster ride amid mixed economic data. After a tumultuous session on Tuesday, which saw the precious metal price plunge close to 6% owing to the profit booking sentiments, consequently, selling continued yesterday’s trading session as well.

But for today, spot gold bounced back above $1,900/oz as investors expects seem to be apprehensive for safe-haven.

However, the release of data showing US consumer prices surged in July, stoking fears of new inflationary pressures and sparking a rebound in investor demand. Gold subsequently rallied to $1,950/oz before further profit taking saw prices ease into the close.

Whether we look at retail investors’ gold allocations or the spec positions on gold futures by hedge funds, we could foresee further room for the gold rally to continue in the months to come amid some price corrections.

OTC Bullion Market outlook:

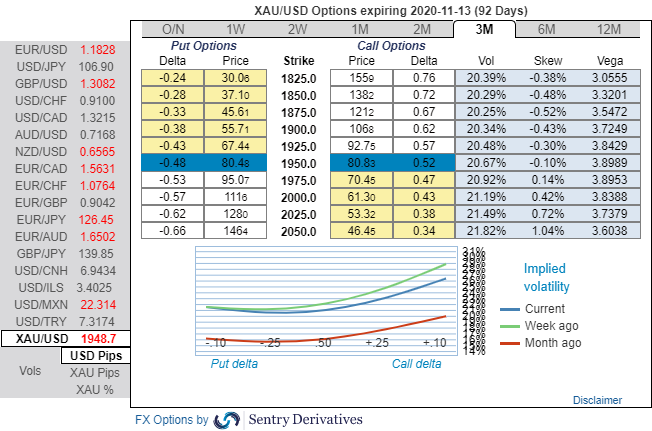

Gold front month ATM vol ended in the recent past where it started, at around 16 vols, currently trading at around 14.78%. We referred to JP Morgan’s Machine Learning based 1M ATM vol model that indicated a moderate sell vol signal for the past week so we were leaning towards selling short term near the money vol.

We advocated shorting ATM puts for 16 vols in our recent posts, bears have delivered as anticipated as the precious yellow metal finally seemed to have taken a halt after a commendable bullish rout, after it hit all-time highs of $2,075 levels, Gold prices sensed overbought pressures.

However, please be noted that 3m skews of gold’s ATM contracts are still indicating upside risks, you can observe the bids for OTM call strikes up to 2050 levels as hedgers foresee further upside risks.

Hence, we continue to expect the extremely strong positive gold spot momentum towards north amid minor dips, to substantiate this bullish stance on broader perspective, observe fresh negative bids to the existing bullish risk reversal set-up indicates the same price swings as explained above.

Hence, capitalizing on the prevailing OTC indications, it’s wise to capitalize on any further corrective price dips for fresh long hedging constructions. Accordingly, on hedging grounds, buying 3M 25D (1%) ITM calls for 17 vols.

Alternatively, on hedging grounds, we already advocated long positions CME gold contracts, as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid geopolitical turmoil and the global financial crisis, we wish to uphold long hedges by rolling over to August’2020 deliveries. Courtesy: Sentry, ANZ & Saxo

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?