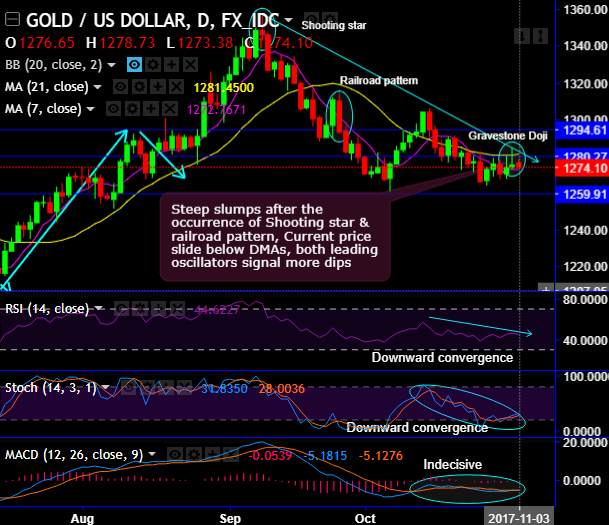

Steep slumps in gold prices have been observed after the occurrence of the shooting star and railroad pattern at $1,346, $1,293.75 and $1,294.75 levels, these bearish patterns hampered previous bullish momentum.

As a result, the current prices slide below 21DMAs, both leading & lagging oscillators signal more dips.

Every attempt of upswings is restrained below 21DMAs from last 1 week.

Stiff resistance is observed at 1,280 – 1,295 levels.

On a broader perspective, after 2-years of the consolidation phase, the major trend now seems to be exhausted again at 38.2% Fibonacci retracement levels with stern bearish swings. As the bulls failed to show the sustenance above this Fibonacci levels and 100-DMAs, the major downtrend now goes non-directional but likely to resume.

RSI on this timeframe, shows faded strength in the consolidation phase, while stochastic curves have been indecisive.

Both lagging indicators have been indecisive that indicates no clarity for trend.

Well, in addition to that, the four Fed-related corrections so far this year averaged sell-offs of $28/oz, $58/oz, $76/oz and $84/oz each, with the current sell-off surpassing $50/oz so far. Considering the higher starting point, we believe the downside trade has room to play out further.

While further weakness in the broad dollar and re-escalation of political tensions could lend some support to bullion prices, we continue to caution against holding gold as a political hedge during the global rate normalization cycle.

Trading tips:

Any abrupt rallies in gold price should be snapped by cautious bears in as soon as the price touches $1281.64 (21DMA) where it sees stiff resistance.

On intraday speculative grounds, contemplating above technical reasoning, we advise tunnel spreads which are binary versions of the debit put spreads.

At spot reference: $1,276, this strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at $1,281.14 (21DMA) and lower strikes at $1,270 levels.

Alternatively, shorts in CME gold futures for Dec’17 delivery have been encouraged at a price of $1,318/oz mid-September. We continue to uphold the position for the commensurate trade target upto $1,190/oz with a strict stop 1 at $1,294/oz and stop 2 at $1,306.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures