Gold trades flat ahead of US elections and Fed monetary policy.It hits a high of $2748 yesterday and now sitting around $2,740.47.

The 2024 U.S. presidential election will be held on November 5, 2024, with polling starting between 6 AM and 9 AM local time. Ballots will be counted after polls close, with initial results expected around 6 PM ET. More detailed results will come in as counting continues throughout the evening.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut decreased to 98% from 98.40% a week ago.

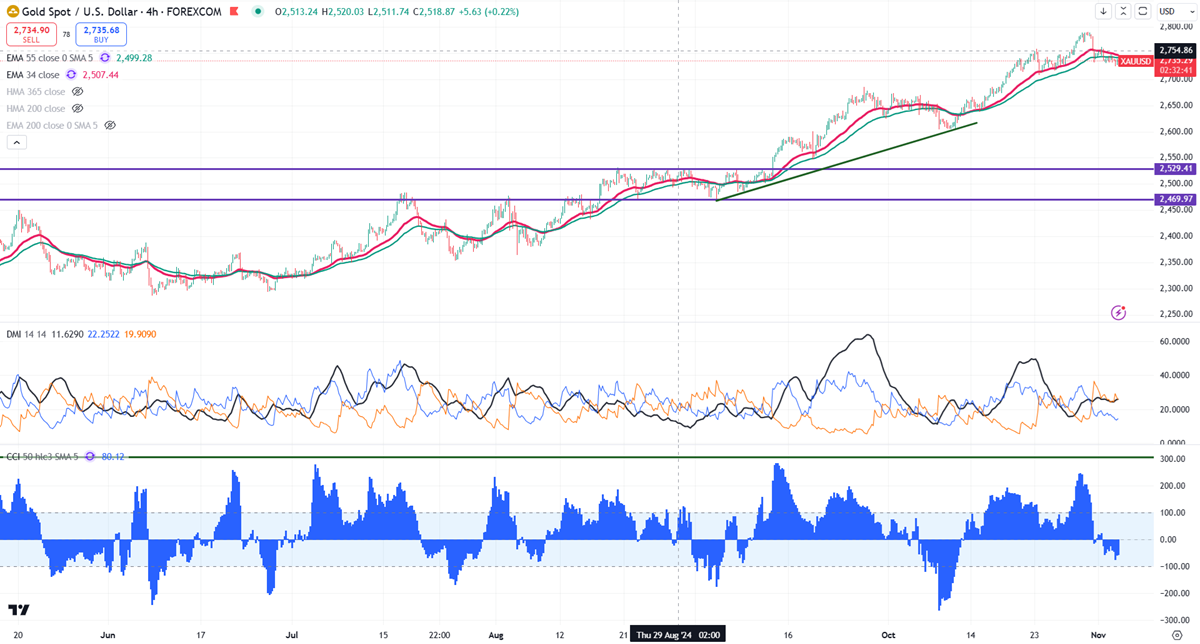

Technical Overview:

Gold remains below both short-term and long-term moving averages on the 4-hour chart. The immediate support level is around $2,732; a fall below this could lead to targets of $2720/$2700/$2,685, $2,670, $2,660, or even $2,638. A bearish trend would only be confirmed if prices drop below $2,470. On the upper side, minor resistance is found at $2,760, and breaking past this barrier could push prices up to $2,775/$2800.

Current market indicators present bearish: the Commodity Channel Index (CCI) indicates a bearish trend, while the Average Directional Movement Index (ADX) suggests a bearish outlook.

Trading Strategy:

Consider making purchases on dips around the 2,700 mark, with a stop-loss positioned around 2,670 and a target price of $2,759.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?