Key Economic Fundamentals:

Canada also prints upbeat numbers at 0.2% (on MoM basis) versus forecasts at 0.1%, whereas Canadian unemployment and trade deficit have been key concerns for last week's BoC policy decision which have led the central bank to keep rates on hold.

Unemployment raised to 7.3% from previous 7.2% and trade deficit expanded to -0.7B from previous flash at -0.6B.

On the other hand, shrink in Japanese GDP is reduced from previous -0.4% to -0.3%.

We saw a steep jump in IP m/m from -0.3% to 0.6%. Tankan’s both manufacturing and Non-manufacturing also posts upbeat numbers 12 and 25 respectively which were beyond forecasts at 11 and 23 respectively.

The central bank of Japan is likely to maintain its pledge of raising the monetary base by JPY 80 trillion on an annual basis and to remain with negative rate of -0.1%. The BoJ, in January’s policy meeting, had brought in QQE with a negative interest rate. So for now, we think BoJ is likely to stand pat in its monetary policy, the BoJ to achieve its 2% price stability target in 2019 and to start hiking interest rates in 2020.

The Japanese Yen finished last week lower against the majority of G10 FX as traders react to ECB & anticipate the BoJ & Fed this week.

CADJPY spot is struggling to approach even minor resistance at 86.378 levels and sustain and as a result CFDs of this pair slightly have been drifting down.

Hedging Framework:

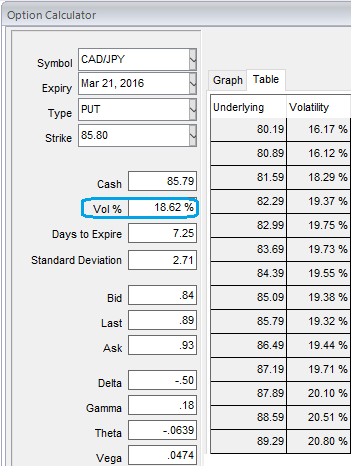

The implied volatility of 1W CADJPY ATM contracts 18.62%.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since ATM IVs are trading 18.62%, shorting expensive OTM or ATM calls during bearish situations with shorter expiries would likely result in positive cash flow on expiration. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute: Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, Short 1M (1%) out of the money call with positive theta.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.

FxWirePro: Hedge CAD/JPY risks via 3 way straddle vs call ahead of BoJ's policy on HY IVs

Monday, March 14, 2016 10:40 AM UTC

Editor's Picks

- Market Data

Most Popular

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock