Among G10 pool, sterling received a shot in the arm from hawkish BoE governor Carney, who said that "the point at which interest rates may begin to rise is moving closer given the performance of the economy".

But for today GBP buying today cannot be ruled out if we get a further rise in average earnings for the three-month period through May (forecasts: 3.3% yoy). But for foreign traders are advised to safeguard their FX exposures through suitable hedging arrangements, we came up with some instances and recommended below strategy. We feel GBP is in good shape but is it good enough to keep our currency exposures in naked positions and confront Yen's uncertainty; this has certainly been a tough call.

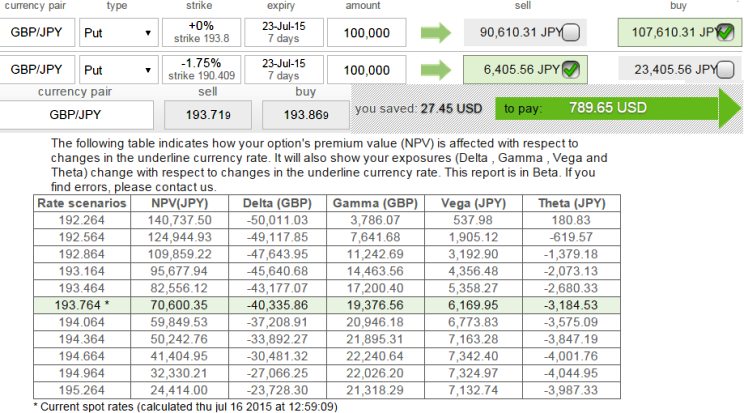

Therefore, bear put spread shall be used over Protective Put as the premiums on naked puts prove too costlier.

Bear Put Spread = Long ATM -0.5 delta Put (193.75) + Sell another -1.75% OTM Put with lower Strike Price (Out of the Money = 190.40) with net delta should be at -0.40.

For net debit bear put spread reduces the cost of hedge by the premium collected (¥6405.56 on the shorts of OTM put) and keeps hedger to participate on upward moves but it comes at the expense of Partial hedge rather than a complete hedge.

FxWirePro: Hedge GBP/JPY with debit put spread to participate in uptrend

Thursday, July 16, 2015 7:52 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand