Ahead of RBNZ’s monetary policy meeting where it announces official cash rates, NZDJPY has resumed its year-old trend decline and targets 74.50 next. The Japanese event calendar is dominated by month-end data, with retail sales Thursday; and jobs, IP, housing and Tokyo CPI Friday. Softer exports data suggests further softening in IP.

Medium-term perspectives: BoJ tightening may be a long way off, but that won’t stop markets from starting to price it in, supporting the yen and pushing NZDJPY down below 75.00 by year-end.

Bearish NZDJPY scenarios:

1) The NZ housing market slowdown becomes disorderly

2) The NZ immigration rolls over quickly

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Bullish NZDJPY scenarios:

1) Fiscal easing is delivered quickly

2) New RBNZ Governor Orr starts with a surprisingly hawkish bent.

NZDJPY’s recent peak is the latest in a series of lower peaks during the past year (refer above technical chart). The recent decline has potential to push below 74.

Our RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%. In addition, the NZ-US interest rate advantage has been eroded, removing one of the previous attractions of the NZD. Further, domestic data is indicating the NZ economy is slowing.

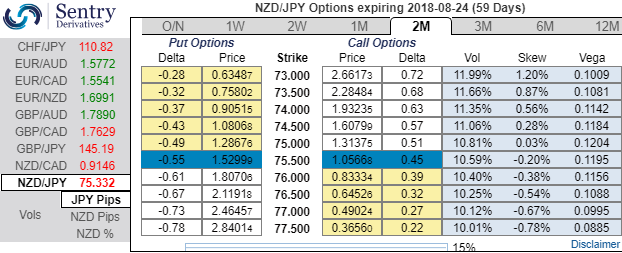

Please be noted that the 2m options skews indicate the hedging sentiments for the bearish risks. Bids are for OTM puts upto 73 levels. As shown in the diagram, the execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

Contemplating both bearish and bullish trends of this underlying pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call) of 1m expiries. The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

One can deploy this strategy both on trading as well as hedging grounds. Please be noted that the strategy is likely to derive positive cash flows regardless of the underlying spot FX moves with more potential on the downside.

Currency Strength Index: FxWirePro's hourly NZD spot index is flashing at -115 levels (which is bearish), while hourly JPY spot index was at shy above 55 (bullish) while articulating (at 11:25 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures