As expected, the statement fell short of providing explicit forward guidance, but we interpret the larger number of risks to the outlook and the RBA’s forecast that average underlying inflation would be stuck at the bottom of the 2-3% target band by the end of 2018 as a strong easing bias.

Our base case is that rates remain on hold at 1.5%, but we see a clear risk of further cuts given the RBA expects persistently low inflation and with banks passing on only half of this week’s rate cut to home loan customers. The AUD is also important given the RBA thinks it still poses a “significant source of uncertainty” around the outlook.

In our view, today’s statement reinforces this risk. With the cash rate now close to the 1% floor for the cash rate, we think the RBA would be looking more closely at unconventional options if downside risks to the outlook materialise.

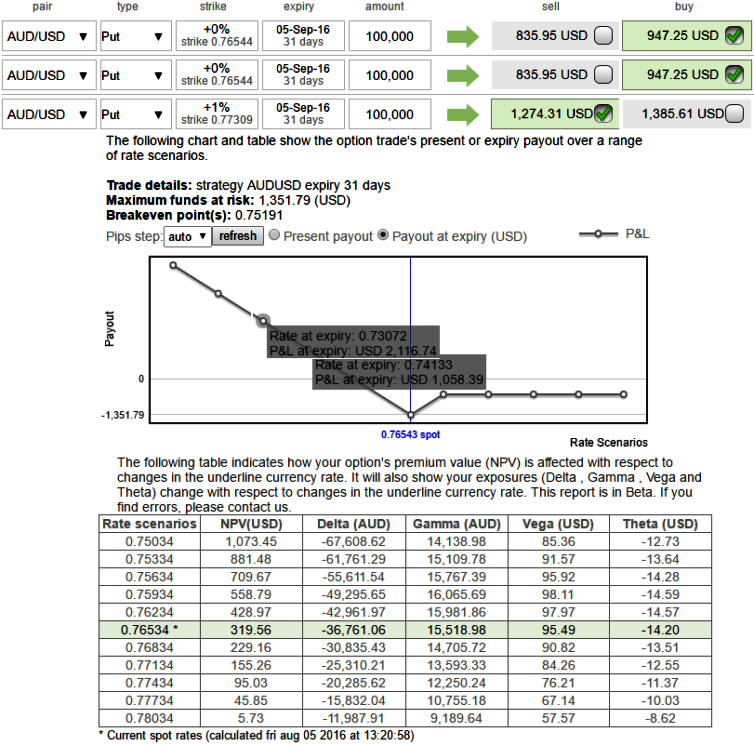

Hedging strategy:

With IV of ATM contracts of this month expiry being marginally inching lower (at around 9.7%), compare this with IV of 3m tenors.

Volatility favors option traders: Traders tend to view the put ratio backspread (PRBS) as a bear strategy, because it employs puts. However, it is actually a volatility strategy. The concept of implied volatility is helping our positions.

So our ITM shorts with shorter expiries have pretty much achieved their objectives, now is the time for longs on 2 lots of At-The-Money -0.50 delta puts and simultaneously expect the underlying currency AUDUSD to make a large move on the downside. We have fundamental reasoning too for this anticipation of the dollar's appreciation against AUD, we would come up with that in our upcoming posts.

Unlike a simple naked put, put backspreads have an extra-long that have leveraging effects and a short option at a lower strike that caps your reward but also reduces the net cost of the trade. So, the recommendation, for now, is to add an extra-long on put with 1W expiry to the existing debit put spreads.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady