We hold EURNZD but via 6m AED call, more in the expectation of getting better levels to close this out than any real confidence that NZD is poised to break down anytime soon.

The RBNZ outlook is also on hold throughout 2018 and is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%.

On the flip side, a constructive stance for EUR is anticipated on the robust cyclical lift in the region and the unwinding of distortions to capital flows and EUR valuation from the unconventional monetary policy. European reflation trade with leverage to trade conflict and erosion in the dollar's reserve status due to missteps on trade and fiscal policy.

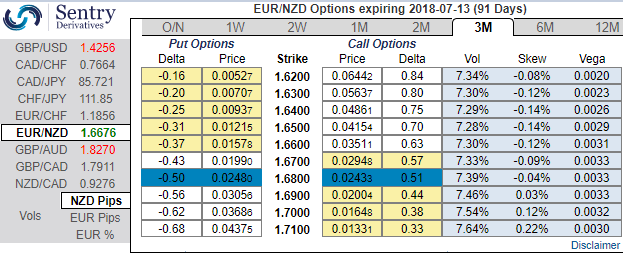

Please be noted that 3m EURNZD IV skews have been indicating hedging sentiments for the bullish risks, positively skewed IVs upto 1.71 levels.

While we pair EUR vs NZD to neutralize the risk to EURUSD from a further repricing of the Fed. The RBNZ is an unlikely candidate to signal tighter policy as the slowdown in migration intensifies the downturn in housing and argues against a policy response to upside inflation risks from minimum wage increase etc. The 3m window KO halves the premium compared to a digital call.

Long a 6m 1.80 EURNZD digital call with a 3m 1.80 window KO. Paid 17.5%. Marked at 19.04%.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -73 (which is bearish), while hourly NZD spot index was at 18 (neutral), USD at 22 (neutral) while articulating at 12:02 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One