Italian government bonds remained under pressure early yesterday but market sentiment improved somewhat around lunchtime following Economy Minister Giovanni Tria’s pledge that he will do whatever is necessary to restore calm if market turbulence turns into a financial crisis. However, a number of risks lie ahead. In FX markets, the GBP was firmer across the board on press reports conveying that the EU and the UK have narrowed their differences on the Irish backstop and an agreement on the terms of the UK divorce could be reached by Monday, in time for the next EU Summit scheduled for 17-18 October.

Markets reaction to the news of a higher-than-expected Italian budget deficit at 2.4% for 2019 announced last week was to a significant extent limited to the Italian Equity and Bonds market, with the 10yr BTP-Bund spread spiking to a 5-yr high above 300 bps earlier on this week. G7 FX vols were largely unaffected, and EMFX vols continued their rather spectacular decline, with the JPM VXYEM vol index almost 3 vol points below its mid-September peak (see our note calling for a drop of EMFX vols two weeks ago).

EUR-crosses dropped by up to 2% on the news; EM currencies’ reaction was modest overall. While the final budget document has not been released yet, Italian risk receded, with the BTP-Bund spread falling to around 280bps, following a press conference on Wednesday evening when the government pledged to cut deficit for 2020 and 2021 compared to the earlier target of 2.4%.

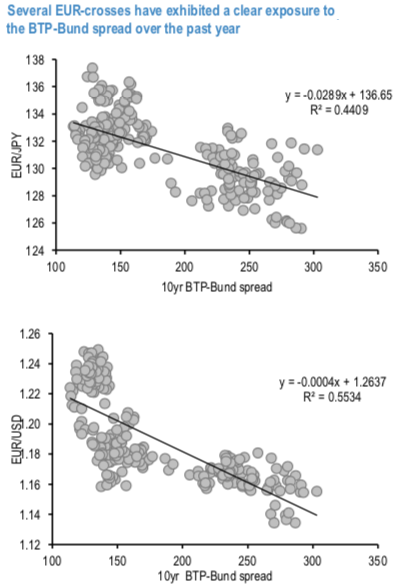

We consider the sensitivity of EURJPY and EURUSD to the 10y BTP-Bund spread by using 1yr of data (refer above chart). While the latest reaction of FX variables to the increased Italian risk was contained, what we find is that these two crosses:

1) Exhibit a clear, directional sensitivity on the BTP-Bund spread, with significant R2 coefficient (around 50%) and that

2) The currencies are at present overvalued based just on this regression estimate (and especially EURJPY, where the regression level is at 128 vs a market value at 131). Similar results can be found on EURCHF, with an R2 of 52%, although in this case the spot value would be modestly above the regression value. If running the analysis on EUR vols, we would find that higher spreads normally call for higher vols, but generally the relationship is much weaker (for the 3M EURUSD vol, the R2 would be just 7%).

We look for options constructs for hedging EUR weakness in case where Italian yields were to rise further. We like considering maturities of around 2M for allowing for the budget to be officially released by the government, voted by the Italian parliament and later reviewed by the EU, in a back and forth process which could extend until the end of November. The fact that EUR vols reacted just modestly to the announcement of the Italian budget makes the entry point of the trade attractive. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 25 (which is mildly bullish), while hourly USD spot index was at -48 (bearish) at 11:23 GMT. For more details on the index, please refer below weblink:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics