Gold futures contracts for December delivery was trading at $1,191.5 a troy ounce while articulating, after earlier rising as high as $1,197.00 on account of dollar strength.

OTC outlook:

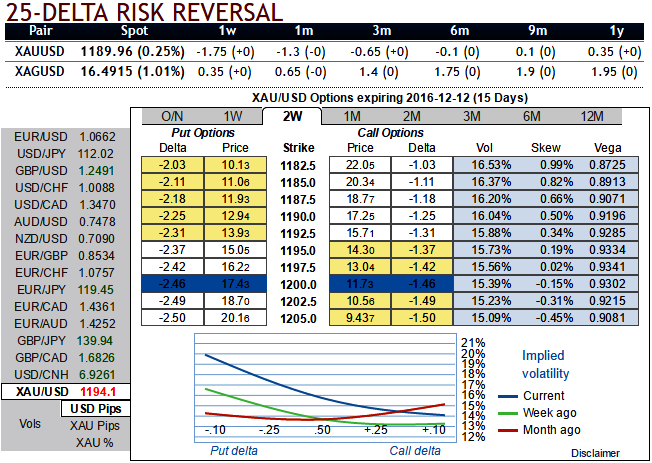

As you can observe the risk reversal flashes for 1 and 3 months tenors, bears in gold prices seem to have more traction ahead of Federal reserve monetary policy announcements, whereas dollar is also likely to risk in 3m tenor, i.e on eve of Christmas where Fed’s chances of hiking can’t be disregarded.

Mounting negative risk reversals coupled with 1m skews would mean that the underlying gold prices likely to slide further and suggests RKO calls on speculative grounds, and 1w-1m skew has been bid with after Trump’s series of speculation and now posing mightier dollar owing to Fed’s booster may lift it to its highest level since June 2015, but in short run underlying precious metal losing the importance of safe-haven sentiment that has been lingering from the recent past.

So, we reckon above fundamentals seem to be addressed by hedging participants via gold’s option market set up. We too accordingly come up with suitable hedging framework considering these developments.

Hedging strategy:

Strategy: 3-Way Diagonal Straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool for 2w IV skews (you could even check for 1m tenors) would signify the interests of OTM put strikes that means the ATM calls higher likelihood of expiring in-the-money.

The execution:

Go long in XAUUSD 1M at the money -0.49 delta put, and go long 1M at the money +0.51 delta call and simultaneously, writing 2W (1%) out of the money call with positive theta. One can initiate strategy as shown in the diagram but please be noted that the tenors shown in the diagram are just for the demonstration purpose, use suitable tenors as per your requirement.

Favor optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment. For speculators, call spreads are preferred to vanilla structures given elevated skew and favorable cost reduction.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts