The instrument of monetary policy in Singapore is the nominal effective exchange rate (NEER) rather than a market interest rate. This is because of the small and open nature of the economy with free capital movement. The Monetary Authority of Singapore (MAS) is the regulator and the central bank.

Its objective is price stability and the policy framework comprises four components, including:

1) The policy bias of the NEER; 2) This is the mid-point of the SGD NEER around which it is allowed to deviate. It was last adjusted in April 2011 where it was re-centred higher to just below the prevailing level of the time. In other words, an upward shift represents a one-off policy tightening and vice versa.

3) The bandwidth around centre the NEER can fluctuate; and 4) basket of key currencies of its major trading partners. To tighten policy, MAS appreciates the NEER and vice versa. It has kept policy neutral since April-2016 given tame inflation.

As of today, we estimate the SGD NEER is at +0.4% above the estimated mid-point for current spot USDSGD at 1.4020, USDCNY at 6.8950, EURUSD at 1.0620, and USDMYR at 4.4310. We estimate the +/-2% range for the SGD NEER corresponds to USDSGD between 1.3800-1.4360, with the mid-point at 1.4070, ceteris paribus (all things equal).

Option Trade Recommendation:

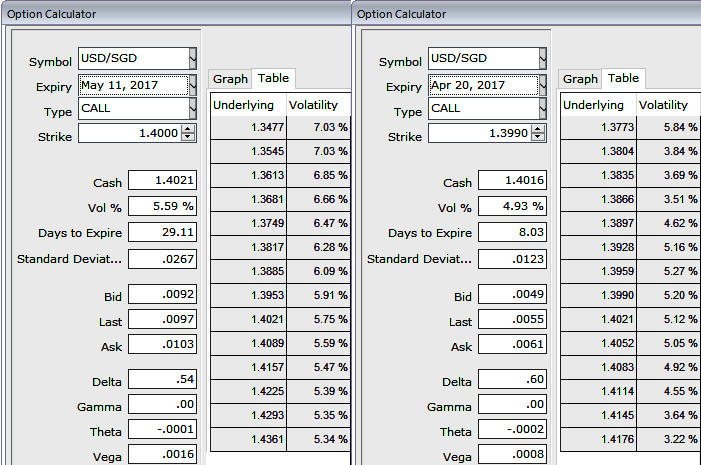

Please be noted that the ATM IVs are tepid despite monetary policy, creeping up at 4.93% and a tad below 5.6% for 1w and 1m tenors respectively. An option writer wants IV to fade away so the premium also shrinks away. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive. Hence, these lower yielding IVs are useful for writers.

Well, amid bearish risky environment, on a hedging perspective the foreign trader who are considerably expect slumps, debit put spreads are advocated as the selling indications are piling up on weekly technical graphs. So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

So, here goes the strategy, Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1W (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure