FX vols have been perplexingly soft over the past two weeks in the face of escalating trade war rhetoric and equity markets’ jitters have been the talking point de jour in FX option circles.

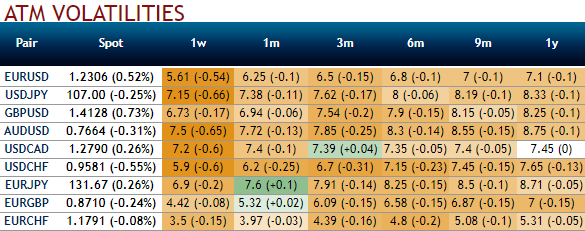

Please be noted that the above nutshell evidencing ATM implied volatilities of G10 FX universe which are at its least, almost across all the tenors, IVs have been shrinking amid trade clashes between the US and China.

Volatility is the heart and soul of options trading. With the proper understanding of volatility and how it affects your options you can profit in any market condition. The markets and individual asset class are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our options strategies.

When we talk about volatility we are referring to implied volatility. Implied volatility is forward-looking and shows the “implied” movement in an underlying asset’s future volatility.

Low volatility trading is tough for options traders. When markets are calm premiums are small and narrow - meaning that we cannot sell options far from the current stock price.

In such low volatile circumstances, options strategies such as ratio spreads, butterfly & iron butterfly spreads, condor spreads appear to be conducive.

VXY Global has flat-lined around 7.5 over the past month, a period over which announcement of tit-for-tat bilateral tariffs by the US and China has escalated trade tensions (refer above chart), notwithstanding soundbites from administration officials on both sides to soothe market anxieties.

Aside from a brief spike around the VIX shock in February, VXY still remains 1-sigma cheap even versus mundane business cycle drivers, to speak nothing of risk premium for a trade war. Explanations for this inertness that we have encountered are largely unsatisfying. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -114 levels (which is bearish) while articulating (at 08:39 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary