The Australian inflation data for Q2 provided a considerable dampener for the rate cut speculation this morning.

The inflation measure preferred by the Australian central bank (RBA), the trimmed mean, remained surprisingly stable at 1.7% YoY.

That means, at least on the inflation front the RBA does not see any urgent need for action. The rise of AUD since late May, on the other hand, is likely to be a reason for concerns for the central bank. That means the door has not been completely shut on a rate cut yet.

On the flip side, This week is a busy one for Japan data watchers with many June releases including CPI, housing starts, and FX markets digesting the better than forecasted trade balance data, while the key focus should be on Friday’s BoJ policy meeting.

If it is judged necessary for achieving the price stability target” (from June Statement on Monetary Policy). The economy has struggled with deflation for two decades. Even after the BOJ's massive qualitative and quantitative easing (QQE) program and venture into negative interest rates territory, the Asian economy hasn't been able to boost domestic consumption and shake off deflation.

Hedging Framework: Capitalize on rallies and HY vols likely to favour PRBS

AUDJPY has consistently been sliding in a sloping channel as selling momentum is intensified as the monetary policies adding extra impetus to the selling pressures, so the foreign traders who have their export or import bills should be hedged by below option strategies.

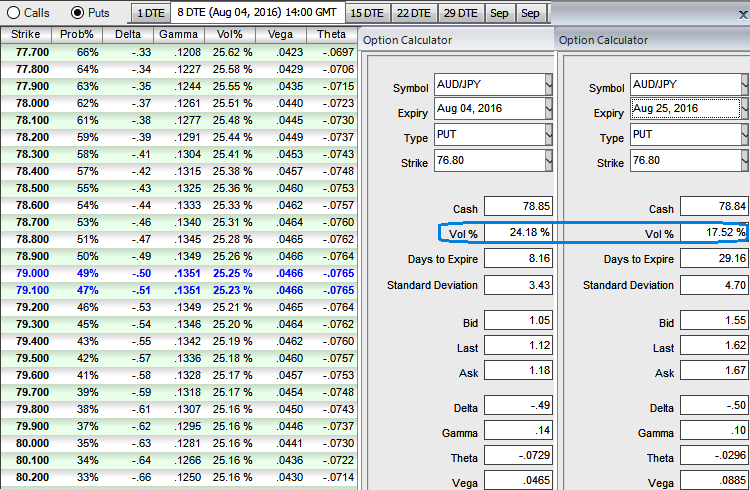

ATM IVs of 1w expiries are flashing at 24.18% and 17.52% for 1m tenor.

While IVs of ATM contracts of 1w and 1m tenors are spiking crazily and this has been justified by historical volatilities in spot FX fluctuations (see big real body candles on monthly technical charts).

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 17.52% and it is quite higher side when long-term trend is bearish.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close