Emerging Asian currencies bloc has taken a beating over the past few weeks, the entire complex initially weakening alongside a generalized upturn in the dollar and then the higher-yielding (INR, IDR) subset unraveling more rapidly in the last few days.

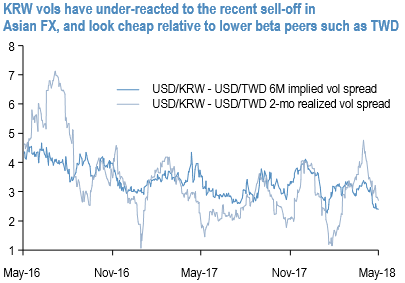

Front-end vols have crept higher to varying degrees across the board since mid-April, with one exception: USDKRW, KRW vols seem cheaper vs TWD. Arguably, a combination of Korea’s large current account surplus, positive sentiment surrounding North Korean de-nuclearization talks and potential central bank smoothing has insulated the currency from the regional malaise.

It is also true that sizeable net equity outflows from the Korean equity market in 1Q’18 may have left the won less vulnerable to Q2’s 5% SPX drawdown. Still, it is odd for implied vols in a high-beta currency like KRW to decouple so starkly from the regional trend at a time when the flowing backdrop is similar in equity-sensitive sensitive peers like TWD, and considering upcoming trade-related event risks in the form of additional US tariff and tech / IP related announcements later in the month that can have ramifications for the entire North Asian tech supply chain.

Owning KRW vol standalone can be a painful proposition however if history is any guide, and the unpredictable longevity of this year’s 1060-1100 range looms as a realized vol drag on short-dated options. Hence the need to pair KRW vega longs in midcurve-to-long expiries with those in CNH and TWD where both implied and realized vols are less supportive (refer above chart).

Of the two, our bias is to choose TWD over CNH given that China is the epicenter of the trade dispute with the US and there are probably still greater residual directional long positions in CNH than TWD that could come in for liquidation should trade actions surprise negatively in coming weeks; if the 2015/16 China stress template is any guide, spec positions in USDTWD might even have flipped from short to long over the past few weeks as investors overlaid a positive carry hedge atop carry-friendly longs in CNH, implying potentially less deleveraging pain/realized vol for TWD if the entire North Asian FX bloc were to come in for sale.

We view the risk/equity beta differential between KRW (higher) and TWD (lower) as a positive for the trade that biases the vol spread wider in broad market stress. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge