NZDUSD medium-term perspectives seem to have delivered its gains in its consolidation phase. NZD preserved its post-GDP gains to 0.7020-50 levels. While AUDNZD rose from 1.0940 to 1.0980.

The New Zealand economy advanced 0.6 percent on quarter in the third quarter of 2017, below the upwardly revised 1.0 percent expansion in the previous period but slightly above the 0.5 percent growth expected by the consensus. Slower growth was mainly explained by a 1.6 percent contraction in utilities, following no growth in the second quarter. Meantime, services grew at a softer pace of 0.6 percent after a 1.0 percent expansion in the previous quarter. In contrast, construction rebounded sharply.

Retains upward momentum, the next technical target 0.7035 (15 Dec high), as long as the USD remains restrained.

If the RBNZ remains firmly on hold, as we expect, and the US dollar rises on the expectation of further Fed interest rate rises in 2018, then we reckon that NZDUSD should drop back to 0.67 over the next few months, the OTC indications are also suggesting the same.

If the Kiwi central bank remains firmly on hold, as we expect, and the US dollar rises on the delivery of a Fed interest rate rise in December, then NZDUSD should fall to 0.67 by year-end.

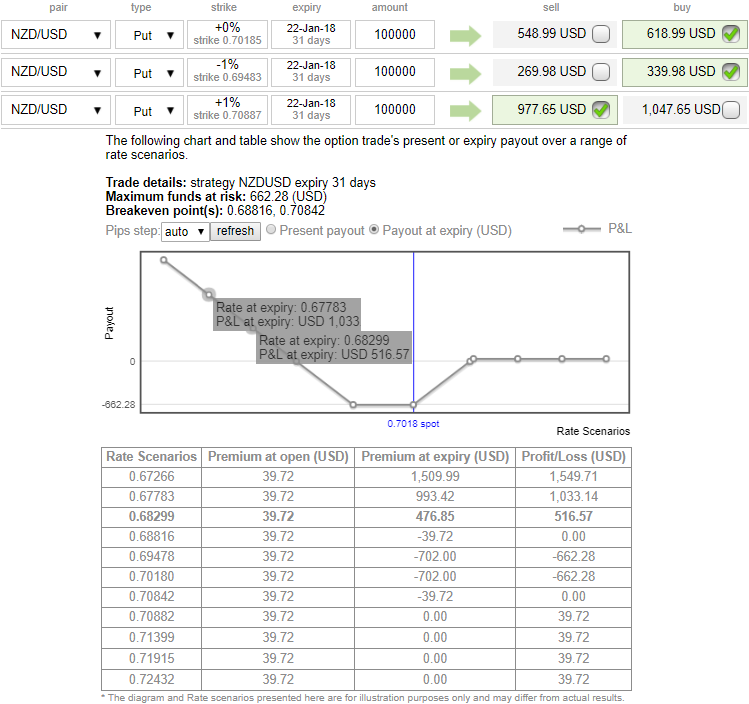

OTC Outlook and Options Trade Recommendations:

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be lowering southwards as the skews have been flashing positive numbers on OTM strikes upto 0.68 or below.

At spot reference: 0.7019, since the 3m skews are targeting OTM put strikes at 0.68, accordingly, we’ve recommended put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

Hence, we recommend writing 1m (1%) in the money put with positive theta snapping decisive rallies. You could easily make out short legs on ITM puts would go worthless considering time decay advantage. Simultaneously, we uphold longs in 1m ATM and 1% out of the money puts, the structure could be constructed either at the zero cost or minor debits. Please observe pay-off structue would be inversely proportionate to the spot FX moves.

Bearish scenarios: NZDUSD forecasts of the slide below 0.67 is majorly driven by:

1) The housing market slowdown becomes disorderly

2) The migration rolls over due to a shift in government policy;

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Theta shorts are recommended in this strategy because Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 45 levels (which is bullish), while hourly USD spot index was at -69 (bearish) while articulating (at 06:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics