New Zealand trade deficit decreased 11.3 pct year-on-year to NZD 705 million in November of 2016, as imports fell faster than exports. It compares with market expectations of a NZD 500 million gap. Key export trends haven’t changed: Export values were a touch softer than expected, driven by lower meat and industrial/manufactured good export returns, weak livestock volumes (especially meat) offset somewhat by higher prices and other export volumes. Imports were a little stronger than anticipated, driven by a bounce-back in petroleum imports from the month before.

By export region, Europe and the UK look challenging due to the weak GBP and euro, and low economic growth. Exports to the US are also weaker, likely due to lower beef exports/prices. China remains the standout, while Australia and Japan continue as support acts.

On the import side, crude oil imports bounced back from October weakness, but there was a fall in capital, intermediate and consumption goods, providing an offset.

OTC outlook and Option strategy:

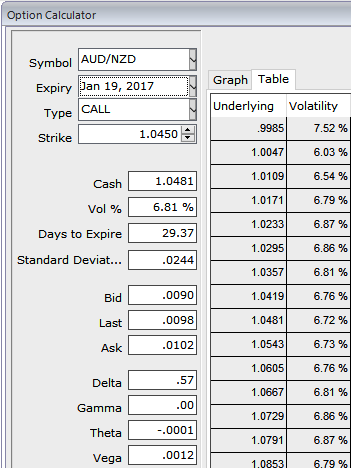

There could be a little volatility this morning as markets await the outcome of the Kiwis quarterly GDP numbers. You could observe that the 1m ATM IVs are trading at shy above 6.8%.

On both hedging and speculative grounds, you could initiate following option positions to construct straps strategy in order to keep underlying spot FX prices on check ahead of above stated fundamental news.

The execution: Buy 1m ATM -0.49 delta put option, while 1w ATM +0.51 delta call and one more ATM +0.51 delta call of 2w expiries, the diagonal tenors are chosen so as to favour the short term uptrend as well as major downtrend, by keeping so the trading cost is reduced with net healthy delta on the strategy.

One can obtain positive cashflows from this strategy regardless of the swings and the oscillating underlying prices could be kept on the check as you have the right buy or sell underlying spot at prevailing prices since we hold both calls and put options.

One can also keep the identical tenors as shown in the diagram and construct the strategy at the net delta of 0.52.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures