New Zealand’s terms of trade rose 0.7% to a record high in the September quarter, with the fall in the price of imports outpacing that of exports. The record-high terms of trade is a valuable support for national income growth at a time when key growth drivers of recent years look set to take a breather. Associated volume figures suggest net exports will make a welcome positive contribution to Q3 GDP growth.

NZD export prices fell 1.9% QoQ: After accounting for NZD moves (+0.8% QoQ on a TWI basis), we estimate that “world” prices fell by around 1% QoQ. Implied world prices for forestry products rose, while the largest decline was in wool prices.

NZD import prices fell 2.6% QoQ which implies lower prices in “world” terms of around 1.8% QoQ. The largest influence was an 11.9% fall in petroleum and related product prices, but declines were broad-based. World oil prices are up around 10% since the end of Q3, so this tailwind for the terms of trade looks set to turn. Both putting together the trade terms hit a 66-year high.

OTC Outlook and hedging strategies:

ATM IVs of NZDJPY is trading between 8.50% and 8.36% for 1w and 1m tenors respectively.

Thus, conservative hedgers can prefer the below strategy:

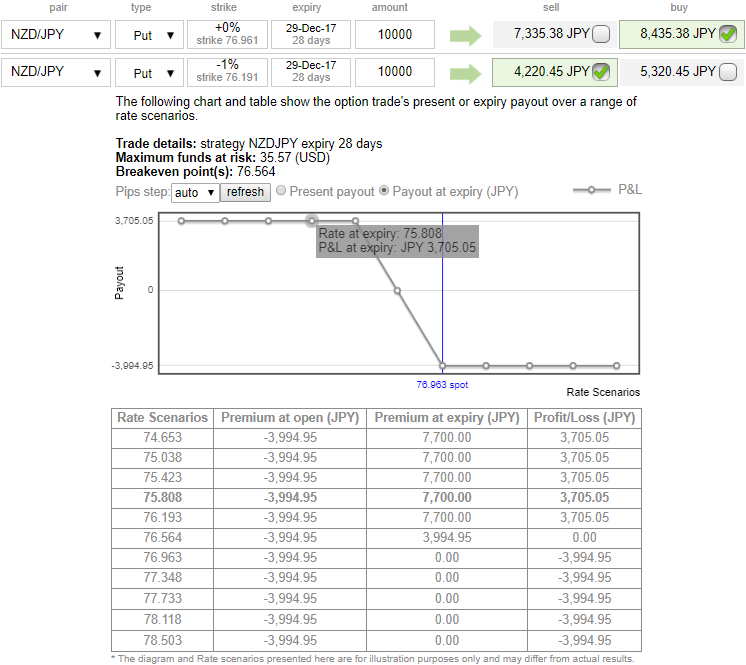

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.46. Please be noted that the positive payoff structure would be generated as it keeps dipping below 76.564 levels as shown in the diagram.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Aggressive bears can bid NZDJPY 1m IVs & RR to buy 75 NZDJPY OTM put of near-month tenors.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -79 levels (which is bearish), while hourly JPY spot index was at shy above -50 (bearish) while articulating (at 11:24 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed