Poor PMIs in Europe and upbeat numbers in UK signal sterling’s recovery against euro – Buying 1w and 1m EURGBP RR optimizes hedging strategies.

Technically, we anticipate more price dips in the short run, while major uptrend seems still intact, but fresh investors with long-term motives may need to wait for a bounce back.

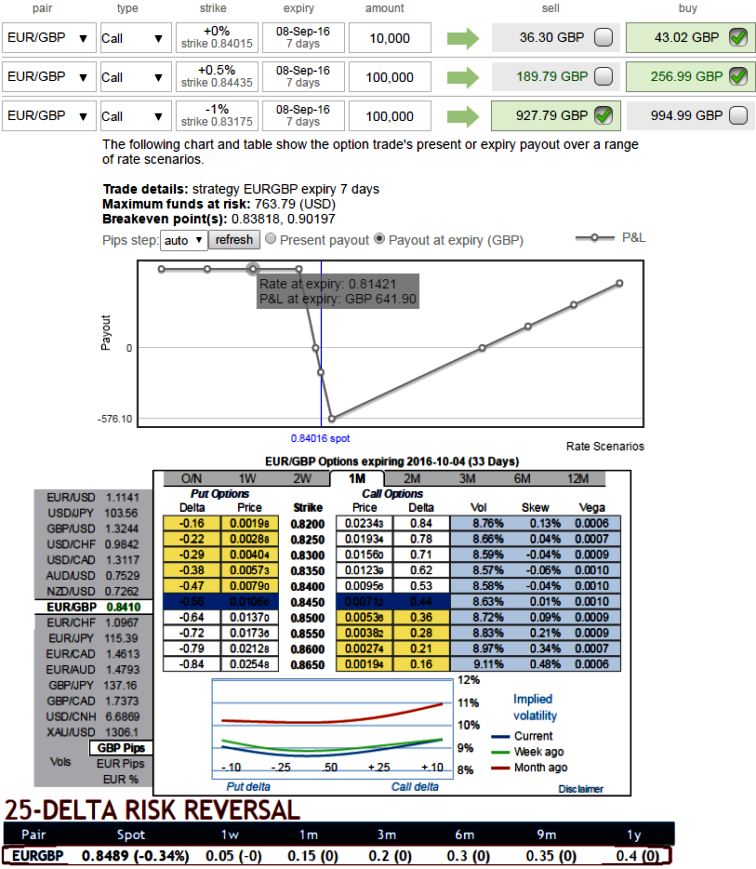

Capitalizing on prevailing dips of this pair one can load up shorts in ITM calls and longs in either ATM or OTM calls in a credit call spread with a narrowed strikes and tenors.

While major uptrend could be arrested by the longs of the underlying pair with longer tenors as you’ve seen the selling momentum is intensified by leading oscillators with mammoth volumes on long-term technical charts.

So it is advisable to initiate Diagonal Credit Call Spread (DCCS) in order to tackle both short-term dips and major uptrend.

Usually, pondering over the option sensitivity tool, IVs and OTC indications these puzzling could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases.

One can understand from the IV and risk reversal nutshell that 1w tenors signify bears hedging interests and so is the sentiments in the long run.

Well, in above case of diagonal credit call spreads, the strategy could be constructed at the net credit, the short leg would be absolutely at profits when underlying spot remains either at strikes chosen or at higher than strikes on an expiration of short side.

Thereafter, the major trend prolongs to evidence further spikes, narrowed OTM longs would mitigate upside risks on the other hand as the holder of such option would be having right buy at predetermined strikes.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed