Markets have been focused on the NZ trade balance and budget.

NZ April 2016 Merchandise Trade prints positive numbers that drives NZD's strength for the moment.

Balance: $292m (Market f/c: $117m)

Exports : $4,300m (Market: $4,420m)

Imports: $4,008m (Market: $4,090m)

Annual balance: -$3,658m (previous: -$3,766m)

Elsewhere, a weak headline jobs number with solid wage growth in US could signal capacity constraints, US unemployment rate is also focus for the day.

With markets pricing very little chance (10%) of a June rate hike, and just north of 50% chance of 1 hike this year there is room for upside and downside surprises.

We are sceptical on NZ budget. From 2018 the economy may be weaker than the Treasury is forecasting due to the wind-down of the Canterbury rebuild and a cooling of the current borrow-and-spend dynamic.

Furthermore, this Budget made no allowance for tax cuts. In reality, tax cuts are a possibility.

Furthermore, RBNZ doesn’t really seem to have eased their economy by reducing 25 bps OCR in last month end or it may take time to factor in this monetary policy decision as GDP (q/q), GDT price index, manufacturing PMIs have reduced considerably and unemployment rates have increased on the other side. Market pricing assigns a 50% chance of the RBNZ cutting on 9 June.

OTC outlook & Hedging Frameworks:

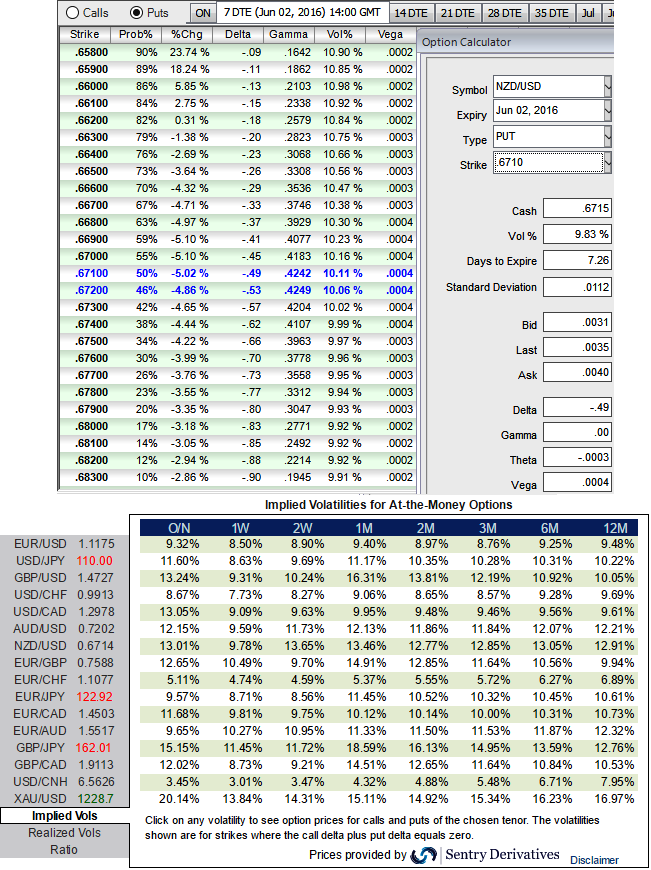

1W ATM IVs are at 10.11% and 12.81% for 1m tenors.

Have a look at the sensitivity table for the different rate scenarios and their probabilistic outcomes, OTM put strikes with higher probabilities and higher gamma would mean that during higher volatility times, these strikes are most likely to finish in the money on expiration.

We've just referred 0.50% OTM put strikes and their vols, it still shows 0.3929 as delta values for underlying outrights with 63% of probabilities, that means 63% chances of finishing in-the-money which is why for demonstration purpose, as shown in the figure we consider the NZDUSD ATM instruments while formulating option strips strategy at spot FX ref: 0.6837.

Hence, Weights are to be more to favour downside risks (3:1), as a result, we recommend holding 2W at-the-money 0.51 delta call and simultaneously hold 1 lot of 1M at-the-money -0.49 delta put options and 2lot of 2M (1%) Out-Of-The-Money -0.36 delta put option.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure